Media release

April 21, 2020Resilient performance on continued order growth

First Quarter 2020 HIGHLIGHTS

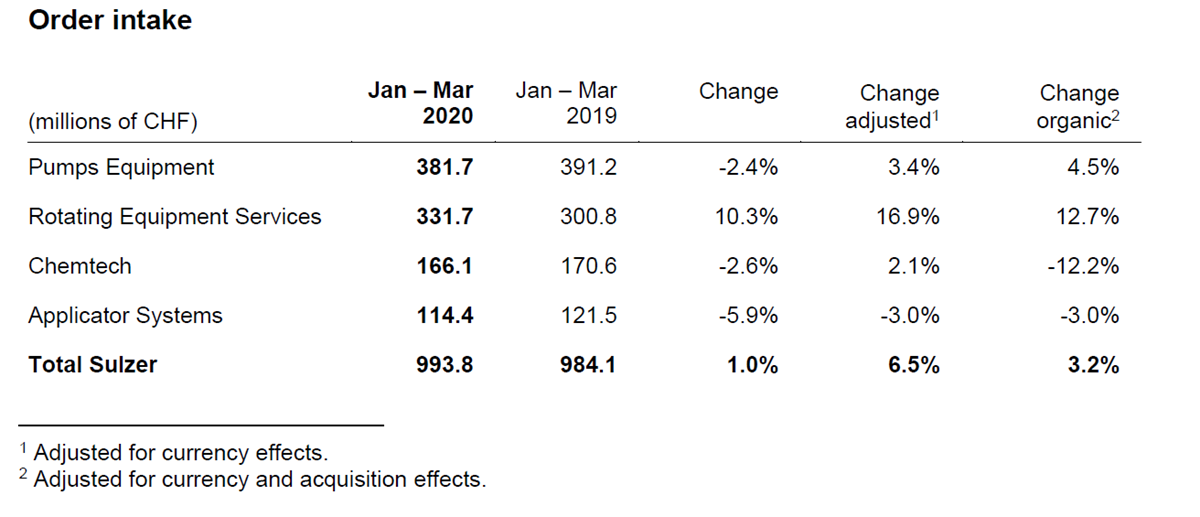

- Orders +3.2% organic, including acquisitions +6.5%

- Strong backlog of CHF 1’925m, 80% of backlog tradable in 2020

- Sales -4.3% organic, including acquisitions -2.2% on China and India temporary sites closure

- CHF 1.6bn of liquidity at beginning of 2020 providing significant headroom in any scenario

- Decisive cost measures launched: CAPEX and OPEX each cut by CHF 60m in 2020

- Structural capacity reduction by one third in Energy initiated

- Dividend maintained on strong balance sheet

- Guidance withdrawn for 2020

In the first three months of 2020, order intake of CHF 994m continued to be strong, growing currency-adjusted by 6.5% and organically by 3.2% despite the Covid-19 lockdown in China in February and a high baseline due to exceptional water infrastructure orders in the first three months of 2019. Currency translation had a negative impact of 5.5% and acquisitions contributed positively by 3.3%.

Order intake from the water market decreased by 16.5% organically, mainly due to the high comparable in 2019; excluding two exceptional water infrastructure orders of CHF 42m from a year ago, orders in water were up 18.1% on strong performance in the municipal water segment. Order intake from oil and gas was up by 24.7% organically, with a particularly strong upstream segment. Power orders grew double-digit while chemicals were up 3.3% on a currency-adjusted basis, whereas they decreased by 6.9% organically, due to a shifting timeline for larger projects in the Chemtech division.

Within the Applicator Systems division, orders from healthcare were significantly up, while dental was negatively impacted by Covid-19 as dental offices only conducted emergency treatments in the second part of the quarter. Order from the adhesives market were flat despite shutdowns in automotive, aerospace and electronics. The beauty segment demonstrated its recovery as orders increased sequentially by 10% to CHF 37.6m, despite an abrupt slowdown in March as retailers shut down.

Geographically, order intake grew in the Americas by +14.6% organically, with the USA and Brazil as main growth drivers. Europe, the Middle East and Africa was organically flat (currency adjusted +2.1%) while Asia-Pacific orders shrunk by 5.3% as China and India were down 6.6% and 2.4% respectively.

Outlook

We expect the commercial impact of the Covid-19 pandemic to be more pronounced in the second quarter on further customer confinement measures, capex cuts in oil and the overall effect of the economic downturn induced by the pandemic.

We entered the second quarter with a high backlog (CHF 1’925m) and a strong liquidity position, which will give us ample flexibility to mitigate risks caused by market disruptions. In addition, we have already initiated decisive adapt measures to protect our business and to continue delivering in a challenging market environment. 2020 CAPEX will be cut by CHF 60m, down to our CHF 70m plants and equipment maintenance CAPEX. 2020 OPEX will also be reduced by CHF 60m through a combination of temporary and structural measures. High oil stocks and lower demand will depress oil prices well into 2021, delaying new projects. Sulzer will correspondingly reduce its Energy capacity by one third, through structural measures predominantly in Pumps Equipment but also impacting group structures.

We expect most of our markets to recover with the global economy beyond Covid-19 as two thirds of Sulzer is low cyclical, including almost half of Sulzer in aftermarket activities. It is too early to assess the profound 2020 impact from the pandemic, not only on our business but on economies. As such, we withdraw our 2020 guidance, which excluded potential impacts of the pandemic.

Q1 presentation

Sulzer will hold a conference call on the occasion of the publication of the first quarter 2020 results today at 11.00 a.m. CEST. The presentation can be followed by webcast (audio slides) or by dialing-in to the conference call. To access the webcast or to dial in to the conference call, use the following links and numbers, respectively:

Webcast:

https://www.sulzer.com/q1_2020_webcast

Dial-in

- Local – London, United Kingdom: +44 (0) 207 107 0613

- National free phone – United Kingdom: 800 279 3956

- Local – New York, United States of America: +1 (1) 631 570 5613

- National free phone – United States of America: 001 (1)866 291 4166

- Local – Geneva, Switzerland: +41 (0) 58 310 5000

- National free phone – Switzerland 080 000 1750

- Other international numbers are available here.

Please dial in 5 minutes before the start of the conference call.

Playback webcast

The playback of the webcast will be available shortly after the event under the same link.

Key dates in 2020

- July 24: Midyear results 2020

- October 29: Order intake Q1 – Q3 2020

Your contacts

Media Relations

Marlène Betschart

Head of Communications

Sulzer Management Ltd

8401 Winterthur

Switzerland

Investor Relations

Thomas Zickler

Chief Financial Officer

Sulzer Management Ltd

8401 Winterthur

Switzerland