Media release

Continued growth and increased profitability in 2019

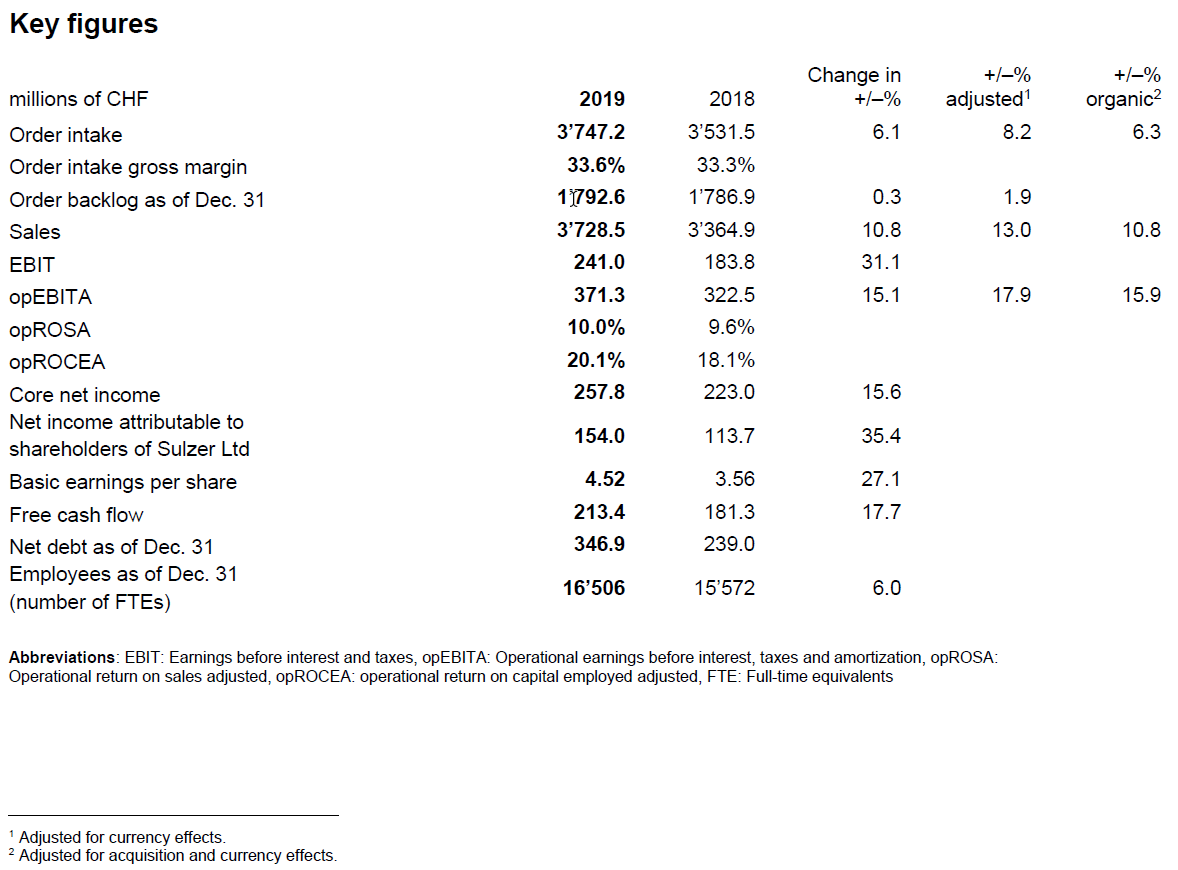

FULL YEAR 2019 HIGHLIGHTS

- Orders +6.3% organic, including acquisitions +8.2%

- Sales +10.8% organic, including acquisitions +13.0%

- Profitability (opROSA) reached 10.0% (+40bps) on higher volumes

- Record free cash flow at CHF 213.4m, +17.7%

- Net income attributable to shareholders CHF 154.0m, +35.4%

- Dividend increase to CHF 4.00 per share proposed

- Guidance for 2020: expected order growth 2% to 4%; sales to increase in the range of 1% to 3%, profitability (opROSA) expected around 10.2% to 10.5%

Strong order growth

Order intake increased by 8.2% compared with 2018. 6.3% organic growth and CHF 68.3 million from acquisitions drove this upsurge. Order intake gross margin increased nominally by 0.3 percentage points to 33.6%, positively impacted by higher order selectivity in Pumps Equipment.

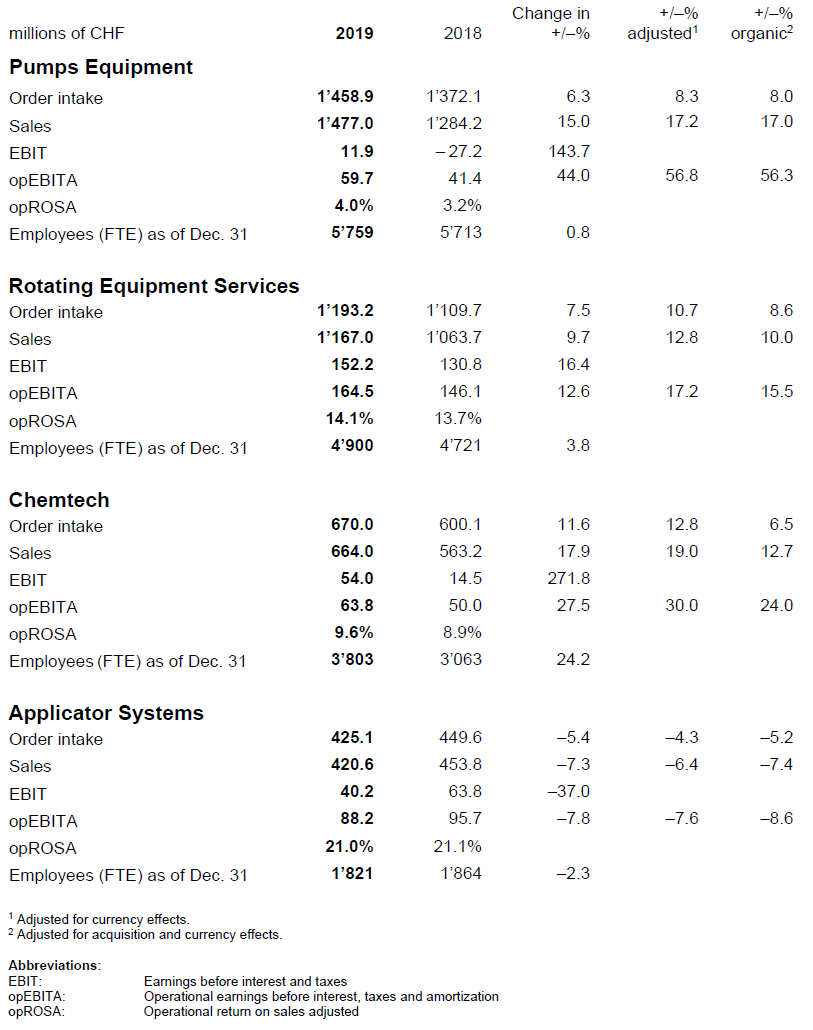

Order intake in Pumps Equipment increased by 8.3%, with 0.3% coming from acquisitions. The strong organic growth was the result of higher orders in the water and chemicals segments which grew 16% each organically. In Rotating Equipment Services, order intake grew by 10.7%, with 2.1% coming from the acquisition of Alba Power and Brithinee Electric. Order intake in Chemtech grew by 12.8%, with organic growth of 6.5% supplemented by the GTC acquisition. In Applicator Systems, orders decreased by 4.3% on disruptive market trends in the beauty segment (down 14.3%), while dental, healthcare and adhesives grew by a combined 2.8%.

Sulzer’s total order intake grew organically by close to 20% in Asia-Pacific as well as 6% in Europe, the Middle East and Africa, while the Americas remained flat on a still depressed Latin American market.

Currency translation effects had a negative impact on order intake of CHF 74.2 million, due to the weaker euro, British pound, Chinese renminbi and Brazilian real, partly offset by the stronger US dollar.

As of December 31, 2019, the order backlog amounted to CHF 1’792.6 million (December 31, 2018: CHF 1’786.9 million). Negative currency translation effects totaled CHF 28.6 million.

Higher sales on strong organic growth and acquisitions

Sales amounted to CHF 3’728.5 million in 2019, an increase of 13.0%. This rise was driven by strong organic growth of 10.8% on a higher order backlog entering the year, the strong order intake during the year and CHF 71.8 million of acquisition-related sales. Negative currency translation effects totaled CHF 72.2 million.

Sales growth was boosted by a tripling of our midstream volumes on a record opening backlog of pipeline projects. Sales to the chemical industry increased by 19.5% and by 4.7% to the water market after strong growth already in 2018. Sales increased by 1.0% to general industries and declined by 3.3% to the power market.

Geographically, sales grew across all regions, most pronounced in the Americas.

Profitability (opROSA) increased to 10.0%

Operational EBITA (opEBITA) amounted to CHF 371.3 million compared with CHF 322.5 million in 2018, an increase of 17.9%. Higher sales, savings of CHF 23 million achieved in the last year of the Sulzer Full Potential (SFP) transformation program and the contribution from acquisitions more than offset the negative mix impact. Overall, the recently completed SFP delivered CHF 253m of cumulative cost savings, ahead of time and ahead of target.

EBIT increased by 34.2%

EBIT amounted to CHF 241.0 million, an increase of 34.2% compared with CHF 183.8 million in 2018. Return on sales (ROS) was 6.5% compared with 5.5% in 2018.

Non-operational costs impacted operating income (EBIT) as plans to consolidate two production facilities in Germany have led to an expense of CHF 27.8 million, consisting of both restructuring provisions and non-operational costs. In the last year of the SFP program, Sulzer has continued to streamline its organizational setup. SFP-related non-operational expenses were CHF 23.0 million and SFP-related restructuring expenses were CHF 2.0 million.

In 2019, net income amounted to CHF 157.7 million compared with CHF 116.5 million in the previous year. Core net income excluding the tax-adjusted effects of non-operational items totaled CHF 257.8 million compared with CHF 223.0 million in 2018. Basic earnings per share increased from CHF 3.56 in 2018 to CHF 4.52 in 2019.

Record free cash flow

Cash flow from operating activities amounted to CHF 319.6 million, compared with CHF 260.8 million in 2018. Free cash flow amounted to CHF 213.4 million compared with CHF 181.3 million in the prior year. This was driven by the higher cash flow from operating activities, partly offset by higher capital expenditure. Capital expenditure amounted to CHF 114.9 million (CHF 142.1 million including IFRS 16 “Leases” impact), above the CHF 96.2 million in 2018. Despite higher sales, overall net working capital remained stable.

A force for sustainable solutions

Sulzer’s purpose and responsibilities do not stop at delivering strong financial results. We aim to harness the power of fluid engineering to make life better, safer and more sustainable.

In Water (13% of 2019 order intake), we play a key role in increasingly efficient systems, transporting clean water and processing waste water to sustain human development.

In Oil and Gas (28% of 2019 order intake, of which close to half is aftermarket), we develop solutions and equipment that deliver market-leading efficiency levels, reducing the environmental footprint of both new and existing facilities.

In Chemicals (21% of 2019 order intake), our separation technologies offer ground-breaking solutions that contribute to the circular economy, with leading positions in biopolymers, biofuels and the recycling of plastics and emissions.

Sulzer continues to pursue significant advances in the areas of health and safety, emissions, water and energy-efficiency, waste management and community engagement. In 2019, we improved our safety performance considerably and reached our lowest ever accident frequency rate (AFR) at 1.7 cases per million working hours (1.1 excluding acquisitions), down 41.3%. Per working hour, we reduced our greenhouse gas emissions by 4.0%, our energy consumption by 1.4% and our percentage of hazardous waste by 3.5 points, while our water consumption went slightly up by 1.6%. And 82% of our employees would recommend Sulzer as a good place to work, while 93% would go the extra mile to help the company succeed.

Outlook for 2020

Macroeconomic clouds formed on the horizon throughout 2019. Geopolitical risks have arisen and trade wars continue to disrupt global flows, generating inefficiencies that weigh on both Sulzer and its customers. And it is too early to estimate the impact of the coronavirus, which is currently affecting our production in and supply chain from China.

Still, we are confident about the prospects of our businesses in 2020. We enter the year with a healthy commercial pipeline, good end market momentum and a solid backlog. On the back of two strong years of high single-digit organic growth and despite increasingly arbitrating for margin at the expense of volume, we still expect order intake to grow in the range of 2% to 4%, and sales to grow in the range of 1% to 3%. Our profitability should further increase, with a 2020 opEBITA margin (opROSA) of around 10.2% to 10.5%.

Changes to the Executive Committee in 2019

Girts Cimermans joined Sulzer as Division President Applicator Systems and member of the Executive Committee on October 21, 2019, succeeding Amaury de Menthière, who retired.

Proposals by the Board of Directors at the Annual General Meeting

The Board of Directors will propose to increase the ordinary dividend to CHF 4.00 per share (previous year: CHF 3.50) at the Annual General Meeting on April 15, 2020. This increase reflects the solidity of our balance sheet and our confidence in Sulzer’s future performance.

The Board of Directors will propose that all existing members be reelected for a one-year term of office. It will also propose Alexey Moskov to be elected as a new and additional member to the Board of Directors, bringing it back up to eight members. This addition would allow Tiwel Holding AG to maintain two representatives on Sulzer’s Board of Directors, as Marco Musetti has given up all his Tiwel mandates and related contractual relationships.

Key figures divisions

Details on the performance of the divisions can be found in the Annual Report 2019:

https://report.sulzer.com/ar19

Annual results presentation

Sulzer will host an annual results presentation today at 09.00 a.m. CET at the Widder Hotel, Rennweg 7, 8001 Zurich, Switzerland.The presentation can be followed by webcast (audio slides) or by dialing-in to the conference call. To access the webcast or to dial in to the conference call, use the following links and numbers, respectively:

Webcast www.sulzer.com/ar19-webcast

Dial-in

- Local – United Kingdom: +44 (0)207 107 0613

- National free phone – United Kingdom: 800 279 3956

- Local – New York, United States of America: +1 (1)631 570 5613

- National free phone – United States of America: 001 (1)866 291 4166

- Local – Switzerland: +41(0)58 310 5000

- National free phone – Switzerland 080 000 1750

Please dial in 5 minutes before the start of the conference call.

Playback webcast

The playback of the webcast will be available shortly after the event under the same link.Key dates in 2020

- April 15 Annual General Meeting 2020

- April 16 Order intake Q1 2020

- July 24 Midyear results 2020

- October 29 Order intake Q1 – Q3 2020

Your contacts

Media Relations

Marlène Betschart

Head of Communications

Investor Relations

Thomas Zickler

Chief Financial Officer