Midyear results 2017

Financial review

Order intake of CHF 1 594.6 million increased by 12.5% compared with the same period last year (nominal: 12.0%). CHF 150 million in orders from acquisitions and 1.9% organic growth drove this upsurge. Order intake gross margin decreased nominally by 0.4% to 34.2% because the larger share of higher-margin aftermarket business just partly offset the price erosion effect in the oil and gas and power markets.

Growth in the Pumps Equipment division was driven by the Ensival Moret acquisition. Organically, Pumps Equipment orders remained broadly stable. Order intake in the Rotating Equipment Services division grew moderately as a result of the Rotec acquisition and slight organic growth. The Chemtech division benefited from a strong rebound of the Chinese market, which compensated for lower order volumes in other geographies. The strong growth in the Applicator Systems division resulted from two effects: the acquisition of Geka and PC Cox as well as healthy organic growth.

Sulzer recorded growth in all market segments except for the water segment. Growth was most pronounced in the general industry segment, driven by the acquisitions of Geka and Ensival Moret. Orders in the oil and gas market grew moderately due to acquisitions and the rebounding Chinese market which positively affected the Chemtech division. Orders in the water market decreased because of fewer larger orders in the engineered water business.

As of June 30, 2017, the order backlog increased by approximately CHF 210 million to CHF 1 649.3 million from CHF 1 439.1 million on December 31, 2016.

Higher sales due to acquisitions

Sales amounted to CHF 1 428.5 million — an increase of 3.7% (nominal: 3.4%). This rise was driven by CHF 143 million in acquisition-related sales, which compensated an organic decline of 6.7% compared with the same period last year.

The Pumps Equipment division recorded a significant decline in sales caused by a lower order backlog in the oil and gas market and timing of projects. This drop was partly offset by additional volume related to the Ensival Moret acquisition. Sales decreased slightly in the Rotating Equipment Services division. Chemtech recorded significantly higher sales as a result of the rebound in China and higher service sales. The Applicator Systems division doubled its sales volume driven by acquisitions (Geka and PC Cox) and healthy organic growth.

Sales increased strongly in Europe, the Middle East, and Africa (EMEA) as well as Asia-Pacific, and declined in the Americas. The share of sales in emerging markets increased from 34.1% in the first half of 2016 to 40.0% in the first half of 2017.

Improved gross margin

Gross margin increased to 31.3% compared with 30.9% in the same period last year. A larger share of higher-margin aftermarket business offset the price erosion effect in the oil and gas and power markets. Total gross profit increased to CHF 446.7 million (first half of 2016: CHF 426.8 million).

Operational return on sales increased to 7.4%

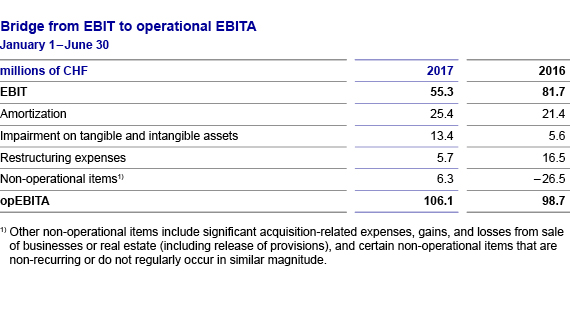

Operational EBITA (opEBITA) amounted to CHF 106.1 million compared with CHF 98.7 million in the first half of 2016, an increase of 7.7%. Savings of CHF 26 million from SFP and the contribution of acquisitions more than offset the impact of market headwinds. OpEBITA decreased organically only by 1.0% despite the pronounced organic sales decline (–6.7%).

Operating expenses excluding amortization, impairment on property, plant, and equipment, restructuring expenses, and other non-operational items increased by 7.0% because SFP savings were exceeded by acquisition-related cost additions.

Operational return on sales (opROSA) increased to 7.4% compared with 7.1% in the first half year of 2016.

If not otherwise indicated, changes compared with the previous year are based on currency-adjusted figures.

EBIT: Operating income

opEBITA: Operating income before restructuring, amortization, impairments, and non-operational items

opROSA: Return on sales before restructuring, amortization, impairments, and non-operational items (opEBITA/sales)

Restructuring expenses and SFP program costs impacted operating income

As part of the SFP program, Sulzer has continued to adapt its global manufacturing capacities and streamline its organizational setup. This resulted in restructuring expenses of CHF 5.7 million in the first half of 2017 compared with expenses of CHF 16.5 million during the same period in 2016. The SFP-related non-operational items, including internal and external program management and planning expenses, were lower than those of last year. Non-operational items further included acquisition-related expenses and the profit reversal of a property sale. In 2016, non-operational items had included a one-time gain of CHF 35.4 million that had resulted from a reduction of the conversion rate of the Swiss pension plans.

Consequently, EBIT amounted to CHF 55.3 million compared with CHF 81.7 million (CHF 46.3 million excluding the abovementioned one-time gain from the Swiss pension plans) in the first half of 2016. Return on sales (ROS) was 3.9% compared with 5.9% in the first half of 2016.

Improved financial income

Total financial income amounted to CHF –4.9 million compared with CHF –13.9 million in the first half of 2016. This was largely driven by lower interest expenses following the bond refinancing in 2016 and lower currency exchange losses (CHF –0.7 million) than in the first half of 2016 (CHF –5.5 million). A negative income from associates of CHF –0.4 million (2016: CHF –0.4 million) was recorded from a joint venture in Asia.

Slightly lower effective tax rate

Income tax expenses decreased to CHF 12.4 million (2016: CHF 16.9 million) mainly as a consequence of lower pretax income. The effective tax rate for the first half of 2017 decreased slightly to 24.8% compared with 25.0% in the first half of 2016.

Higher core net income

In the first half of 2017, net income amounted to CHF 37.6 million compared with CHF 50.5 million in the previous year. Core net income, which excludes the tax-adjusted effects of non-operational items, totaled CHF 75.9 million compared with CHF 63.3 million in the first half of 2016. Basic earnings per share decreased from CHF 1.48 in the first half of 2016 to CHF 1.08 in the first half of 2017.

Key balance sheet positions

Total assets as of June 30, 2017, amounted to CHF 3 783.6 million, which is an increase of CHF 47.7 million from December 31, 2016. Non-current assets increased nominally by CHF 63.2 million mainly due to higher other intangibles (CHF +40.9 million) and higher goodwill (CHF +22.7 million) from acquisitions. Current assets decreased nominally by CHF 15.5 million, as a lower cash balance was partly offset by higher inventories and other receivables.

Total liabilities nominally increased by CHF 142.6 million to CHF 2 287.5 million as of June 30, 2017. The main reason was an increase of CHF 141.7 million in current borrowings to fund acquisition payments.

Equity decreased nominally by CHF 94.9 million to CHF 1 496.1 million, mainly as a result of the abovementioned effects.

Free cash flow seasonality in line with prior year

Sulzer’s free cash flow generation is usually back-end loaded. Free cash flow amounted to CHF –2.5 million compared with CHF 3.7 million reported in the first half of 2016. This change was the result of an increase in net working capital and higher income tax payments.

Cash flow from investing activities totaled CHF –111.2 million compared with CHF 156.0 million in the first half of 2016. In the first half of 2017, cash flow from investing activities was driven by CHF 84.2 million of acquisition-related payments and CHF 34.1 million in purchases of property, plant, and equipment. The positive cash flow from investing activities in the first half of 2016 was mainly caused by the sale of CHF 208 million in marketable securities to fund the dividend payments, partly offset by purchase of property, plant, and equipment and acquisition-related payments.

Cash flow from financing activities totaled CHF 11.7 million compared with CHF – 629.3 million in the first half of 2016. In the first half of 2016, dividend payments of CHF 617.5 million included a special dividend of CHF 498.1 million. The net change in cash since January 1, 2017, amounted to CHF – 101.6 million, including exchange losses on cash and cash equivalents of CHF 11.6 million.

Outlook 2017

Despite some stabilization of order levels in the oil and gas market seen in the first half of 2017, an impending recovery could translate into a commercial rebound for Sulzer only in the course of 2018. Sulzer’s other businesses are expected to continue to grow slightly in the second half of 2017 despite increased price pressure as a consequence of reduced market volume. This should lead to an organic order level for the company that is slightly up versus 2016, supplemented by additional volume from newly acquired businesses.

Sulzer expects its SFP program to deliver incremental cost savings in 2017 in the range of CHF 40 to 60 million. The company confirms its overall SFP run rate savings target of CHF 200 million from 2018 onwards.

For the full year 2017, Sulzer is updating its guidance on order intake. The company previously communicated that order intake would grow by 5 to 8%. The updated guidance indicates that order intake is expected to grow by 7 to 10%. The company confirms its guidance on sales and operational EBITA margin. Sales are forecast to grow by 3 to 5%. The operational EBITA margin (opROSA) is expected to be around 8.5%.