Midyear Results 2016

Financial review

Order intake of CHF 1 423 million was 9.1% below the same period last year (nominal: – 10.1%). However, it improved by 9.8% sequentially, compared with the second half year of 2015. Order intake gross margin increased nominally by 1.7 percentage points to 34.6%, mainly due to a higher share of aftermarket business.

Growth in the water, power, and general industry markets positively affected order intake. Growth in the water and power markets largely related to Pumps Equipment. Chemtech’s Sulzer Mixpac Systems (SMS) business unit drove growth in the general industry market.

Market headwinds affected oil and gas order intake substantially (approximately – 20%) in the first half of 2016. Looking at the oil and gas market, the company recorded significantly fewer new equipment orders in Pumps Equipment and Chemtech. Order levels just slightly decreased in Rotating Equipment Services and the Pumps Equipment aftermarket business. Compared with the second half year of 2015, oil and gas order intake grew by approximately 6% in the first half of 2016.

The divisions reported the following order intake growth rates (year on year):

- Pumps Equipment: – 11.5% (nominal: – 12.5%)

- Rotating Equipment Services: – 3.7% (nominal: – 5.4%)

- Chemtech: – 9.1% (nominal: – 9.7%)

As of June 30, 2016, the order backlog had increased to CHF 1 548 million from CHF 1 511 million on December 31, 2015.

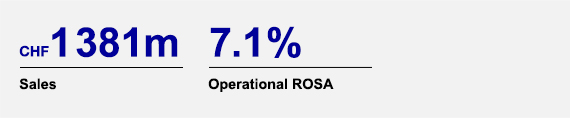

Sales on the previous year’s level

Sales amounted to CHF 1 381 million and were stable compared with the first half of 2015 (– 0.1%). The currency translation effect totaled CHF – 10.9 million. In Pumps Equipment, sales increased in the oil and gas and the power markets. Rotating Equipment Services recorded slightly lower sales, mainly in the Europe, Middle East, and Africa (EMEA) region. The sales volume in Chemtech was negatively affected by a lower order backlog in the oil and gas market and was only partially compensated by higher volumes in SMS.

The divisions reported the following sales growth rates (year on year):

- Pumps Equipment: 3.3% (nominal: 2.6%)

- Rotating Equipment Services: – 1.4% (nominal: – 2.8%)

- Chemtech: – 6.7% (nominal: – 7.1%)

Gross margin decreased by 0.4 percentage points to 30.9% compared with 31.3% in 2015. Benefits from the SFP program partly compensated the lower gross margin, which was affected by the strong headwinds in the oil and gas market. Total gross profit decreased by CHF 9.3 million to CHF 426.8 million.

Sales

Sales amounted to CHF 1 381 million and were stable compared with the first half of 2015 (– 0.1%).

Statistics

Statistics

Statistics

Statistics

Statistics

operational EBITA

| millions of CHF | 2016 | 2015 |

| EBIT | 81.7 | 47.6 |

| Amortization | 21.4 | 20.5 |

| Impairment on tangible and intangible assets | 5.6 | - |

| Restructuring expense | 16.5 | 7.9 |

| Non-operational items1) | -26.5 | 22.3 |

| opEBITA | 98.7 | 98.3 |

1) Non-operational items include significant acquisition-related expenses, gains, and losses from sale of businesses or real estate (including release of provisions), and certain non-operational items that are non-recurring or do not regularly occur in similar magnitude such as expenses related to the Sulzer Full Potential (SFP) program.

Non-operational expenses

In the course of implementing the SFP program, the company adapted global workshop capacities and streamlined its organizational setup. This resulted in restructuring expenses of CHF – 16.5 million in the first half of 2016 compared with expenses of CHF – 7.9 million during the same period in 2015. The SFP-related non-operational items, including internal and external program management and planning expenses, were slightly lower than last year. Non-operational items further included a gain of CHF 35.4 million resulting from a reduction of the conversion rate of the Swiss pension plans. In 2015, non-operational items had included cost of CHF – 8.7 million related to a settled dispute with the purchaser of the locomotive business Sulzer sold in 1998.

Consequently, EBIT for the first half of 2016 amounted to CHF 81.7 million compared with CHF 47.6 million in the first half of 2015. Return on sales (ROS) increased to 5.9% compared with 3.4% in 2015.

Net financial income amounted to CHF – 13.9 million compared with CHF – 11.5 million in the first half of 2015. In 2015, financial income included interest expenses from the settled dispute mentioned above. In 2016, financial income included higher hedging costs and negative revaluation differences. The oil and gas market downturn caused negative income from associates of CHF – 0.4 million (2015: CHF 2.8 million) from joint ventures in Asia and in the Middle East.

The effective tax rate in the first half of 2016 amounted to 25.0% compared with 28.5% in the same period of 2015. Adjusted for the one-time impact of the abovementioned dispute settlement, the effective tax rate in 2015 would have been 25.9%.

Stable core net income

Net income from continuing operations totaled CHF 50.5 million, a nominal increase of 81.4% compared with the first half of 2015. Core net income, excluding the tax-adjusted effects of amortization, impairments, restructuring, and other non-operational items, came to CHF 63.3 million compared with CHF 65.9 million in 2015. Basic earnings per share (EPS) increased by 87.4% from CHF 0.79 in the first half of 2015 to CHF 1.48 in 2016. This is mainly due to a reduction of the conversion rate of the Swiss pension plans.

Key balance sheet positions

Total assets on June 30, 2016, amounted to CHF 3 630 million. This was CHF 625 million lower than on December 31, 2015, largely resulting from the ordinary and special dividends amounting to CHF 618 million, paid in April 2016.

Total liabilities increased by CHF 56 million from December 31, 2015. This increase was mainly due to higher defined benefit obligations of CHF 97 million, lower trade accounts payable of CHF 24 million, and lower advance payments from customers of CHF 24 million. The CHF 493 million bond was refinanced on very favorable terms via a new dual tranche bond issuance of CHF 450 million on June 6, 2016, with settlement date July 11, 2016.

Total equity was CHF 1 553 million (December 31, 2015: CHF 2 234 million). The decrease of CHF 681 million was mainly caused by the dividend payments of CHF 618 million. That payment included a special dividend of CHF 498 million; it was paid out in April 2016. In 2015, the ordinary dividend payment to Sulzer shareholders amounted to CHF 119 million.

Net liquidity of CHF 60 million

Free cash flow generation is expected to be backloaded this year. It amounted to CHF 3.7 million compared with CHF 33.3 million reported in the same period last year. Lower advance payments from customers and higher accounts receivables resulted in higher net working capital. This increase of net working capital was partly offset by lower tax payments compared with the previous year.

Cash flow from investing activities totaled CHF 156.0 million because of the sale of CHF 208.0 million in marketable securities to fund the dividend paid in April 2016. In 2015, an increase of marketable securities by CHF 99.0 million resulted in a negative cash flow from investing activities of CHF – 186.0 million. Acquisition-related payments of CHF 14.5 million were lower than in the previous year (2015: CHF 63.2 million). Capital expenditure of CHF 33.8 million (2015: CHF 33.2 million) was broadly on last year’s level.

Cash flow from financing activities contained the dividend payment of CHF 617.5 million (including the special dividend of CHF 498.1 million) compared with CHF 119.2 million in the first half of 2015. The net change in cash amounted to CHF – 437.8 million, including exchange losses on the cash positions of CHF – 0.9 million.

Outlook 2016

For the full year 2016, Sulzer is updating its guidance on order intake. The company previously communicated that order intake would be in the range of – 5% to – 10%. The updated guidance indicates that order intake will be at the higher end of that range, closer to – 5%. The company confirms its guidance on sales and operational EBITA margin. Sales are forecast to decline in the range of 5% to 10%. The operational EBITA margin (opROSA) is expected to be approximately 8%.

If not otherwise indicated, changes compared with the previous year are based on currency-adjusted figures.

EBIT: Operating income

ROS: Return on sales (EBIT/sales)

opEBITA: Operating income before restructuring, amortization, impairments, and non-operational items

opROSA: Return on sales before restructuring, amortization, impairments, and non-operational items (opEBITA/sales)

EPS: Basic earnings per share