News releases

July 27, 2017Organic Order Growth and Improved Profitability

For the full year 2017, Sulzer is updating its guidance on order intake. The company previously expected order intake to grow by 5 to 8%. Now Sulzer forecasts order intake growth of 7 to 10%. The company confirms its guidance on sales and operational EBITA margin.

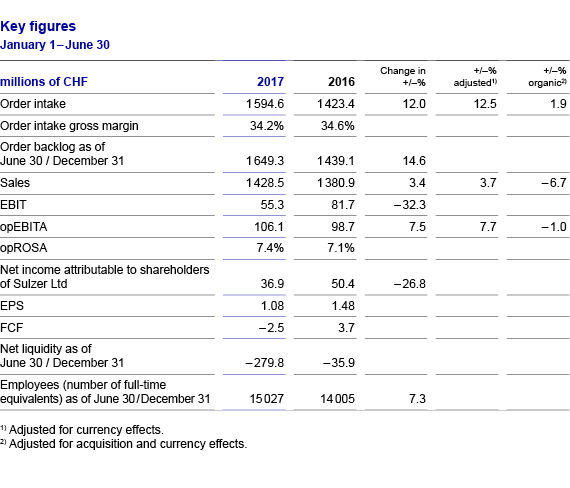

Performance in the first half of the year4

In the first half year, order intake increased by 12.5%. Of this, 1.9% was organic and 10.6% through acquisitions. Orders from the oil and gas market stabilized at a low level with increased activity in the downstream market segment. Order intake from the power market increased through the acquisition of Rotec. Orders from the water market decreased because of fewer larger orders in the engineered water business, while the municipal water market remained active. General industry orders grew through acquisitions.

Sales increased by 3.7% on a currency-adjusted basis, whereas they decreased by 6.7% organically compared with the same period of the previous year. The organic decline is mainly due to decreasing sales volumes from the oil and gas market in the Pumps Equipment division.

Operational EBITA increased on a currency-adjusted basis. Despite lower organic sales volumes, operational ROSA increased to 7.4% from 7.1% in the first half of 2016. EBIT amounted to CHF 55.3 million in the first half of 2017, impacted by restructuring expenses and SFP program costs. In 2016, non-operational items had included a one-time gain of CHF 35.4 million resulting from a reduction of the conversion rate of the Swiss pension plans. Excluding this one-time gain, EBIT would have totaled CHF 46.3 million.

Acquisitions and SFP as foundation for growth

Acquisitions announced in 2016 contributed a total of CHF 150 million to Sulzer’s overall order intake. In May 2017, the company signed a binding agreement to acquire Simcro, positioning its Applicator Systems division in another attractive end-market segment — animal healthcare.

The company is on track for additional SFP savings in 2017 of CHF 40 to 60 million. Sulzer also confirms its goal of cumulative savings of CHF 200 million from 2018 onwards. All of the savings are secured through actions already launched. SFP has helped the company counterbalance adverse market impacts in the past and will benefit margins as the market rebounds.

Outlook

For the full year 2017, Sulzer is updating its guidance on order intake. The company previously communicated that order intake would grow by 5 to 8%. The updated guidance indicates that order intake is expected to grow by 7 to 10%. The company confirms its guidance on sales and operational EBITA margin. Sales are forecast to grow by 3 to 5%. The operational EBITA margin (opROSA) is expected to be around 8.5%.

Results in detail

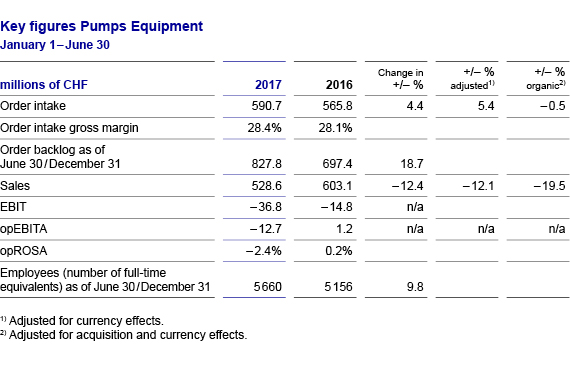

Pumps Equipment: Order intake increased, sales under pressure

In the first half year of 2017, Pumps Equipment reported a growing order intake on a currency-adjusted basis and remained broadly stable organically. While oil and gas orders grew, power orders declined. The water segment decreased, due to fewer larger orders in engineered water. The general industry segment was up on the acquisition of Ensival Moret.

Currency-adjusted and organic sales decreased. This largely comes from significantly lower sales volumes from the oil and gas market, which is due to last year’s lower order intake, and the timing of projects.

The division’s operational EBITA turned negative, mainly driven by lower organic sales volumes. Consequently, operational ROSA amounted to a negative 2.4%. As previously announced, the pumps spare parts business was transferred from Pumps Equipment to Rotating Equipment Services as of January 1, 2017. With the back-end loaded sales profile of the remaining new equipment business, the company expects profitability to break even in the full year.

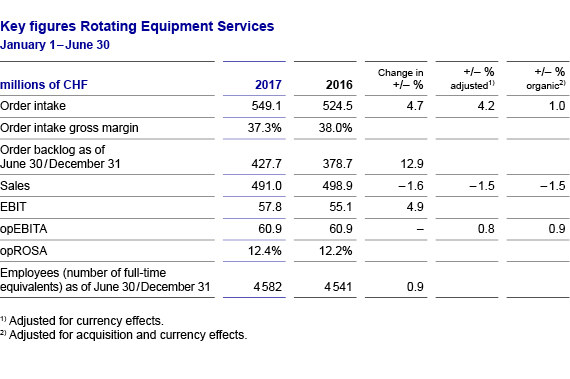

Rotating Equipment Services: Higher order intake, sustained profitability

Order intake increased both on a currency-adjusted basis and organically compared with the same period of the previous year. The increase was triggered largely by turbo services which reported growing order intake despite increased competition from original equipment manufacturers. Pumps services (including parts) and the electromechanical business also grew.

Organically, sales decreased slightly from the previous year’s level, mainly due to the weaker order intake in the Americas in the last quarter of the previous year.

Operational EBITA was on the previous year’s level, resulting in an operational ROSA of 12.4% compared with 12.2% in the first half of 2016.

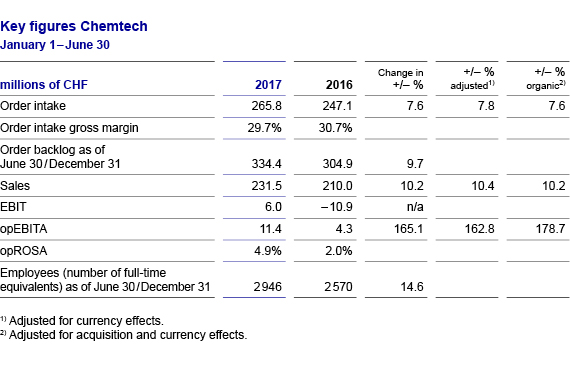

Chemtech: Growing order intake, sales and profitability

Chemtech reported growing order intake compared with the same period of the previous year, both on a currency-adjusted basis and organically. The increase is largely due to the robust performance of the Separation Technology business.

In the first half of 2017, currency-adjusted and organic sales increased. This is in line with the higher order intake last year. Higher sales in the tower field services business stemming from the execution of previously booked large projects also contributed to the increase.

Operational EBITA increased strongly on higher sales volume and operational improvement measures. Accordingly, operational ROSA improved to 4.9%.

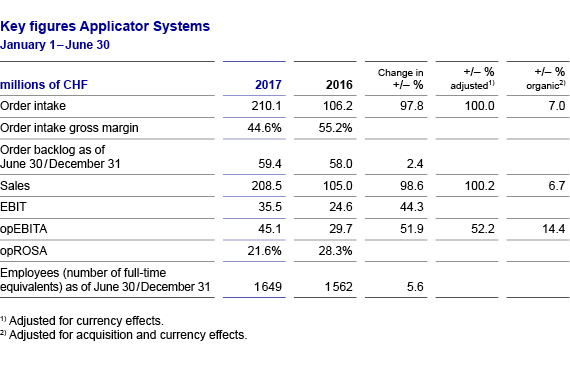

Applicator Systems: Sales and profits increased

By nature of the business, there is little difference between order intake and sales at Applicator Systems. Organic sales increased by a currency-adjusted 6.7% in the first half of 2017. The acquisitions of Geka and PC Cox contributed an additional CHF 98.1 million in sales, boosting the growth rate to 100% on a currency-adjusted basis. Organic growth was driven by the industrial adhesives and dental segments.

Operational EBITA increased to CHF 45.1 million in the first half of 2017 from CHF 29.7 million in the same period of the previous year, mainly due to acquisitions. Operational ROSA is not comparable with the first half of 2016 because of the impact of the Geka acquisition which was closed in the second half of 2016 and is therefore not included in the comparable base.

1 Adjusted for currency effects.

2 Adjusted for acquisition and currency effects.

3 CHF 46.3 million excluding the one-time gain from the Swiss pension plans of CHF 35.4 million.

4 If not otherwise indicated, changes compared with the previous year are based on currency-adjusted figures.

Abbreviations:

EBIT: Operating income

ROS: Return on sales (EBIT/sales)

opEBITA: Operating income before restructuring, amortization, impairments, and non-operational items

opROSA: Return on sales before restructuring, amortization, impairments, and non-operational items (opEBITA/sales)

EPS: Basic earnings per share

FCF: Free cash flow

Key dates in 2017

October 26: Order intake Jan. – Sept. 2017