Financial information

-

Sulzer midyear result 2019 presentationpdfLanguages:

-

Annual results presentation 2018pdfLanguages:

Greg Poux-Guillaume, CEO

The company’s strong performance in the first half of this year and continued robust customer inquiries lead us to raise our forecast for the full year.

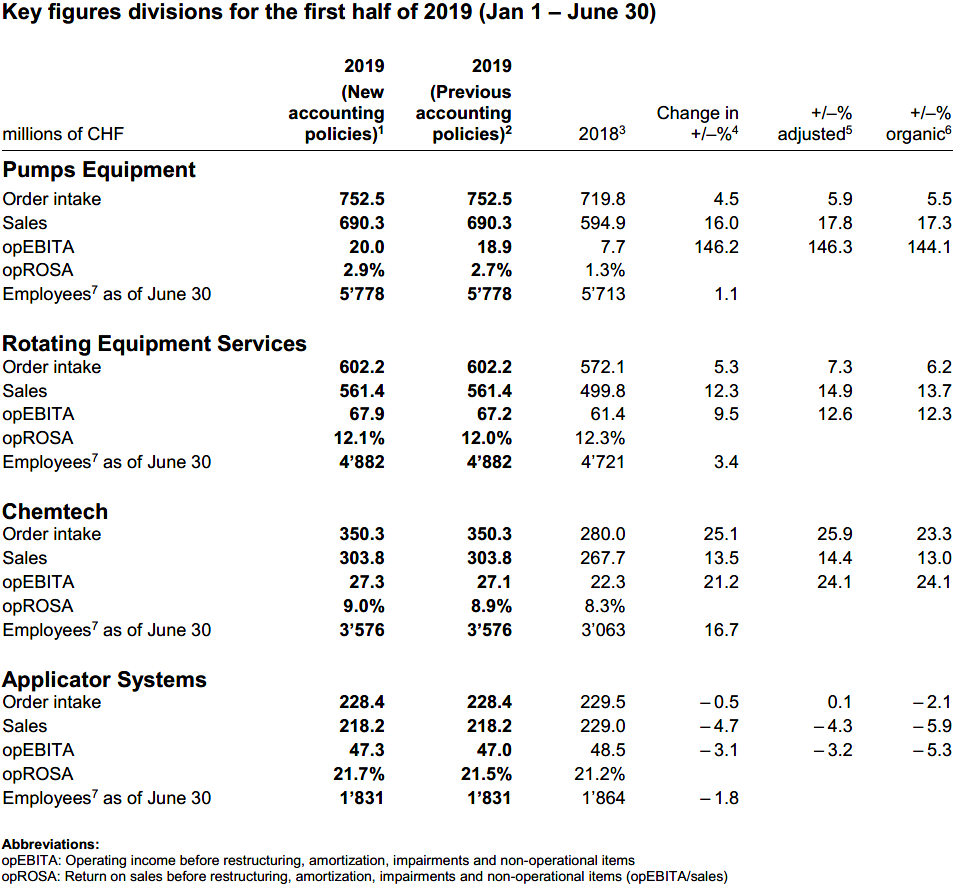

Order intake in the Pumps Equipment division increased by 5.9%. The increase stemmed from 5.5% organic growth, supported strongly by large projects in the Water market (+21.7%) where Sulzer was awarded two large projects for desalination and water pipeline pumps in the Middle East. Growth in the Oil and Gas segment (+7.1%) maintained its momentum.

Order intake in the Rotating Equipment Services division grew by 7.3%, mainly organically. All product lines – Pump Services, Turbo Services and Electromechanical Services – contributed to growth, with a particularly strong demand for Pump Services. On July 2, 2019, Sulzer announced the acquisition of Alba Power, a leading independent service provider for aero-derivative gas turbines in Aberdeen, UK. With that acquisition, Sulzer diversifies its gas turbine service business into distributed power and offshore as well as marine applications.

The Chemtech division grew by 25.9% driven by organic growth of 23.3%, with all regions contributing. Chemical customers, which account for close to 60% of Chemtech, continue to add capacity at a sustained pace. The GTC Technology acquisition announced in May 2019 added CHF 7.8 million in order intake over the quarter. GTC develops technologies and commercializes licensed processes for the petrochemical industry worldwide. It strengthens Chemtech’s leadership in petrochemical processes.

Order intake in the Applicator Systems division remained flat. Adhesives, Dental and Healthcare grew at a collective 6.1%, of which 2.5% organic. Beauty temporarily declined as growth is increasingly captured by a more fragmented, viral-marketing driven customer base. Sulzer remains the market leader in brush-based beauty applications and is investing in a significant transformation of its industrial base to better serve these customers.

Double-digit sales growth

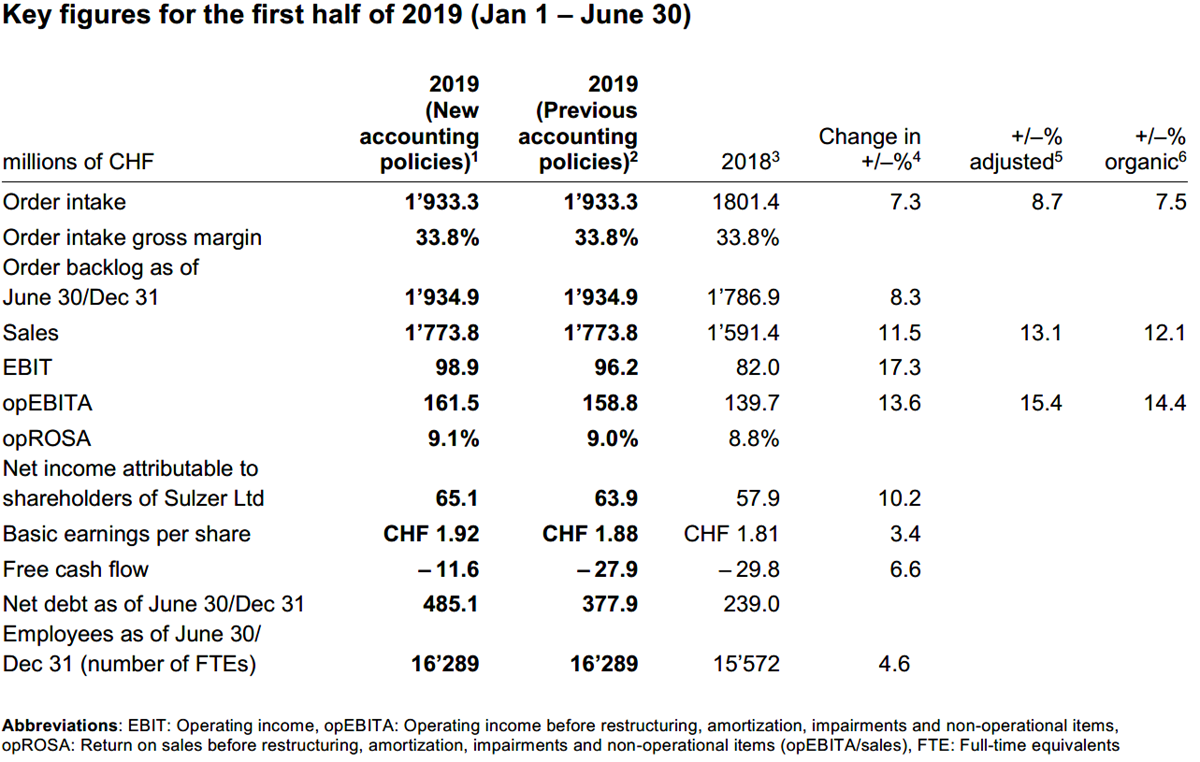

Sales amounted to CHF 1’773.8 million. This increase of 13.1% was 12.1% organic, with the addition of CHF 15.7 million from recent acquisitions.

Sales grew 28.1% in the Oil and Gas and Petrochemical markets on a high order backlog and supported by slight contributions from acquisitions. Sales to the Chemical Processing Industry increased by 26.1% and by 4.7% to the Industry market. Power sales declined by 0.5%, also due to a lower backlog at the beginning of the year. Water sales declined by 0.7% after a strong increase in 2018.

Operational EBITA (opEBITA) amounted to CHF 158.8 million compared with CHF 139.7 million in the first half of 2018, an increase of 15.4%. Higher sales volume, savings from the Sulzer Full Potential (SFP) program of CHF 11 million, proportionally lower operating expenses, and acquisitions contributed to this increase. OpEBITA increased organically by 14.4%. Operational EBITA margin (opROSA) increased to 9.0% compared with 8.8% in the first half year of 2018.

As it concludes the SFP program in 2019, Sulzer is continuing to adapt its global manufacturing capacities to evolving market and business conditions. Up to June 2019, SFP-related non-operational expenses were CHF 7.8 million. Plans to consolidate two Applicator Systems factories in Germany are underway, for which restructuring provisions of CHF 14.4 million and non-operational costs of CHF 6.4 million were recorded in the first half of 2019. Consequently, EBIT amounted to CHF 96.2 million, an increase of 18.2% compared with CHF 82.0 million in the first half of 2018. Return on sales (ROS) was 5.4% compared with 5.2% in the first half of 2018.

While Sulzer is not immune to the climate of economic uncertainty that percolates from some of the markets or geographies that the company is active in, the company does not see at this point signs of a slowdown in its leading indicators.

Based on sustained customer inquiries and a strong performance in the first half of this year, Sulzer increases its guidance. The company raises its forecast for order intake to grow by 6% to 9% (previously 2% to 5%), and sales to grow by 7% to 9% (previously 3% to 5%), adjusted for currency effects and including an acquisitions effect of 2%. Sulzer maintains its forecast of reaching an opEBITA margin of around 10% in 2019.

Sulzer Ltd will hold a short conference call on the occasion of the publication of the midyear results 2019:

Date: Wednesday, July 24, 2019

Time: 09:00 a.m. CET / 03:00 a.m. EST

The presentation can be followed by webcast (audio slides) or by dialing-in to the conference call. To access the webcast or to dial in to the conference call, use the following links and numbers, respectively:

Webcast:

Please dial in 5 minutes before the start of the conference call

Playback webcast

The playback of the webcast will be available shortly after the event under the same link.

Media Relations

Domenico Truncellito

Group Head of External Communications

Sulzer Management Ltd

Neuwiesenstrasse 15

Investor Relations

Thomas Zickler

Chief Financial Officer

Sulzer Management Ltd

Neuwiesenstrasse 15