Media release

October 25, 2018Organic growth in order intake further strengthened

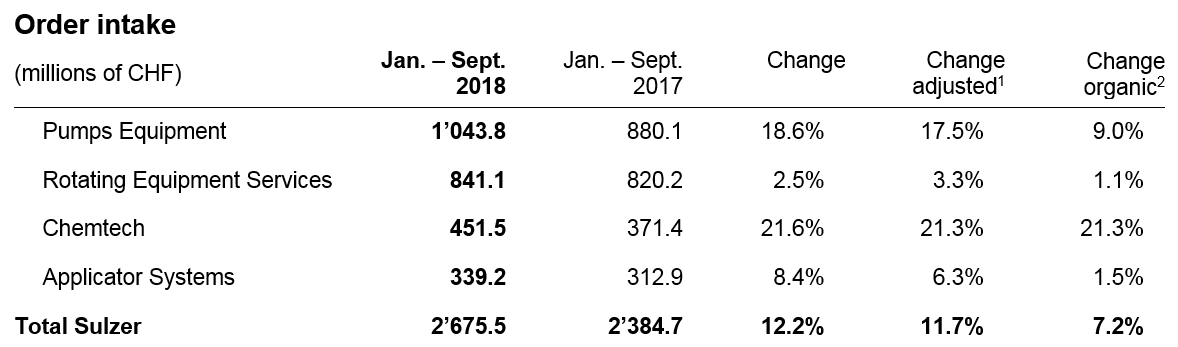

In the first nine months of 2018, order intake rose by CHF 291 million, with currency-adjusted growth of 11.7% and organic growth of 7.2%. Currency impact was a positive 0.5% and acquisitions contributed CHF 107 million. Order intake grew in all of Sulzer’s target markets with the exception of the power market. Some larger orders in Pumps Equipment and Chemtech also supported growth.

Order intake from the oil and gas industry was up by 21% organically compared with the same period last year. A rebound was noticeable in all segments and was particularly strong in upstream. Sulzer also recorded high organic growth rates in other markets, such as water (16%), CPI (24%), and dental (10%). In contrast, orders from the power industry decreased significantly (-22%).

Orders increased across all regions. Growth was particularly strong in the Americas, followed by Asia-Pacific and Europe, the Middle East, and Africa (EMEA).

Free float increased

On September 18, Sulzer placed all five million of its treasury shares with domestic and international investors, and increased the free float to 51%. The placement price of CHF 112 per share, calculated against the purchase price of CHF 109.13 per share in April 2018, resulted in a capital gain of around CHF 15 million that increases Sulzer’s equity. Sulzer acquired the five million treasury shares from its former majority shareholder Renova.

Financing mix optimized

On June 19, Sulzer raised CHF 400 million in the Swiss capital market via a dual tranche issuance to optimize its financing mix. The first tranche of CHF 110 million has a term of two years and carries a coupon of 0.25% at a price of 100.00%. The second tranche of CHF 290 million has a term of five years and carries a coupon of 1.30% at a price of 100.00%.

Taking advantage of favorable market conditions, Sulzer raised another CHF 460 million in the Swiss capital market again via a dual tranche bond issuance on September 27. The first tranche of CHF 210 million has a term of three years and carries a coupon of 0.625% at a price of 100.0%. The second tranche of CHF 250 million has a term of six years and carries a coupon of 1.6% at a price of 100.1%. The additional bonds further optimize the maturity profile of Sulzer’s financing mix. They will also support the company’s bolt-on acquisition strategy.

Guidance increased for order intake and confirmed for sales and opEBITA margin

The order intake momentum is expected to extend into Q4. Sulzer therefore increases its guidance for 2018 order intake growth to 10-12%, up from 7-10% previously, including acquisitions and adjusted for currency effects. Sulzer’s guidance for 2018 sales and opEBITA margin remains unchanged: sales are expected to grow by 6-8% and operational EBITA margin to be around 9.5%.

Sulzer expects that the above-mentioned guidance combined with lower non-operational expenses will result in a significantly higher growth rate for net income compared to the growth rate of opEBITA.

1Adjusted for currency effects.

2Adjusted for acquisition and currency effects.

Conference call

Sulzer’s CEO Greg Poux-Guillaume will hold a short conference call following the publication of the nine months order intake 2018:

Date: Thursday, October 25, 2018

Time: 09:00 a.m. CET

To access the conference call, please use the following numbers:

Dial-in

local

United Kingdom: +44 (0)207 107 0613

United States of America: +1 (1)631 570 56 13

Switzerland: +41 (0)58 310 50 00

Dial-in national free phone:

United Kingdom: 800 279 3956

United States of America: 001 (1)866 291 4166

Switzerland: 080 000 1750

(payphone)

Switzerland: 080 000 1752

(mobile)

Please dial in 5 minutes before the start of the conference call.

Your contacts

Media Relations

Domenico Truncellito

Group Head of External Communications

Sulzer Management Ltd

Neuwiesenstrasse 15

Switzerland

Investor Relations

Thomas Zickler

Chief Financial Officer

Sulzer Management Ltd

Neuwiesenstrasse 15

Switzerland