Midyear Results 2016

Letter to Shareholder

In the first half of 2016, sales, operational EBITA, and operational ROSA remained stable compared with the same period of the previous year. Order intake decreased versus a strong first half of 2015, mainly impacted by the reduced demand in the oil and gas market. To counterbalance the challenging market headwinds we are facing, we accelerated our Sulzer Full Potential (SFP) program. Also, we signed a binding agreement to acquire the German company Geka GmbH on July 1, 2016. We are excited about the opportunities this opens for Sulzer.

Greg Poux-Guillaume, CEO, and Peter Löscher, Chairman of the Board of Directors

Sales, operational EBITA, and operational ROSA remained stable, while order intake decreased year on year, but recovered sequentially.

Creating a leader for proprietary B2B mixing and applicator solutions

Geka is a great addition to our most profitable business unit — Sulzer Mixpac Systems (SMS). Through this transaction, SMS gains critical industrial mass and segment and geographical diversification. Both businesses share the same industrial core in high-precision plastic injection molding, which allows for significant cost synergies. Geka and SMS have complementary geographic manufacturing footprints, which will enable the combined business to compete globally as a leading solution provider.

SMS adds Geka’s leading position in the cosmetics segment to its current leadership in the dental and industrial adhesive segments. This extends its attractive, low-cyclicality portfolio of B2B end-market segments for high-precision plastic injection molding applications.

Sulzer also acquired PC Cox Group Ltd. headquartered in Newbury, UK, in April. Together, PC Cox and SMS are a leading manufacturer of dispensers for industrial applications.

Through these two transactions, Sulzer doubled the size of SMS and has created a leader for the differentiated and resilient market for proprietary B2B mixing and applicator solutions. We are happy to bring the teams of Geka and PC Cox on board and are excited about the prospects of the combined business.

SFP progress

The SFP program is running at full speed. In the first six months of 2016, we have realized savings from SFP of CHF 36 million. We expect savings to be in the range of CHF 60 to 80 million by the end of 2016 and annual savings of about CHF 200 million in a steady state from 2018 onwards.

Our global procurement organization is operational and is leveraging scale effects. Our IT department is working on a new organizational footprint with improved cost structures. Our Pumps Equipment division is further refining its global operations network. It introduced a new production planning system to improve profitability and on-time delivery. Our Rotating Equipment Services division restructured its activities and simplified its footprint. Our Chemtech division, facing sustained pressure on manufacturing costs in Switzerland, announced the closing of its manufacturing facility in Oberwinterthur, Switzerland, in March 2016.

These restructuring measures are painful but they are the key to our competitiveness tomorrow and beyond.

Performance in the first half of 2016

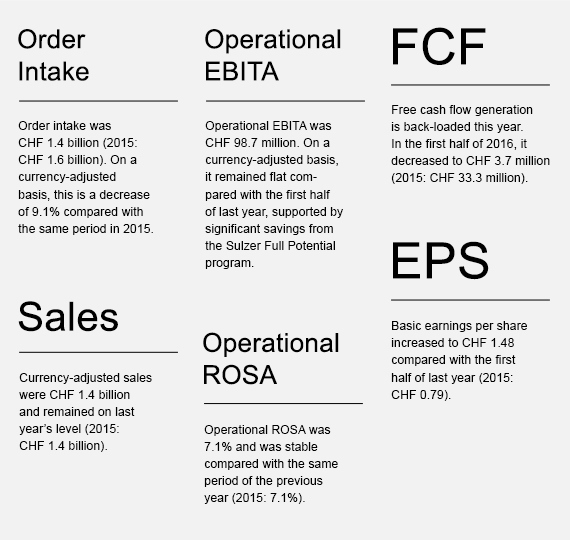

Currency-adjusted order intake decreased by 9.1% in the first half of 2016 year on year. The main trigger for this decline was the weak oil and gas market. However, it improved by 9.8% sequentially, compared with the second half year 2015. Although oil prices have recently recovered somewhat, our customers remain cautious and we do not anticipate a market upswing in 2016. Order intake in all other market segments increased.

Currency-adjusted sales remained stable compared with the same period of the previous year. Operational EBITA and operational ROSA were on the same level as in the first half of 2015. Market headwinds have been fully offset by savings from the SFP program.

Cash flow generation is backloaded this year and includes, to date, a CHF 24 million of SFP cash-out. As such, we delivered a slightly positive free cash flow in the first half of 2016.

Changes in the Board of Directors and the management

Axel C. Heitmann and Mikhail Lifshitz were elected as new members of the Board of Directors at the Annual General Meeting in April. Klaus Sturany did not stand for reelection. The Board of Directors appointed Armand Sohet as Chief Human Resources Officer and Frédéric Lalanne as Chief Commercial and Marketing Officer. Both became members of the Executive Committee. Daniel Bischofberger was appointed as Division President Rotating Equipment Services and will be a member of the Executive Committee. He will take over from Peter Alexander, who has decided to retire and will step down at the end of August 2016. Fabrice Billard, Chief Strategy Officer and member of the Executive Committee, has decided to leave Sulzer on July 31, 2016. Oliver Bailer, Division President Chemtech, is on an indefinite leave of absence for family reasons. Torsten Wintergerste, Chemtech Senior Vice President, took over from Oliver Bailer ad interim.

Outlook

For the full year 2016, Sulzer is updating its guidance on order intake. The company previously communicated that order intake would be in the range of –5% to –10%. The updated guidance indicates that order intake will be at the higher end of that range, closer to –5%. The company confirms its guidance on sales and operational EBITA margin. Sales are forecast to decline in the range of 5% to 10%. The operational EBITA margin (opROSA) is expected to be approximately 8%.Yours sincerely,

|

|

|

Peter Löscher

|

Greg Poux-Guillaume

|

If not otherwise indicated, changes compared with the previous year are based on currency-adjusted figures.

EBIT: Operating income

ROS: Return on sales (EBIT/sales)

opEBITA: Operating income before restructuring, amortization, impairments, and non-operational items

opROSA: Return on sales before restructuring, amortization, impairments, and non-operational items (opEBITA/sales)

EPS: Basic earnings per share

FCF: Free Cash Flow