Ad hoc announcement pursuant to Art. 53 LR

July 22, 2021Record profitability and cash flow on continuing sales momentum

Midyear 2021 HIGHLIGHTS

- Orders up 11.7% (+7% organic) in Q2 YOY, +8.4% sequentially

- Sales up 9.2% (+6.1% organic) in H1, with all divisions growing

- Operational Profitability (opEBITA%) at H1 record of 10.0%, up 250 bps YOY

- Free Cash Flow tripled YOY to reach H1 record of CHF117m

- Planned Applicator Systems (APS) division spin-off to shareholders announced, to be renamed medmix and listed separately on SIX

- Orders in APS up more than 50% organically in H1, well above pre-pandemic levels

- Recently increased 2021 guidance confirmed

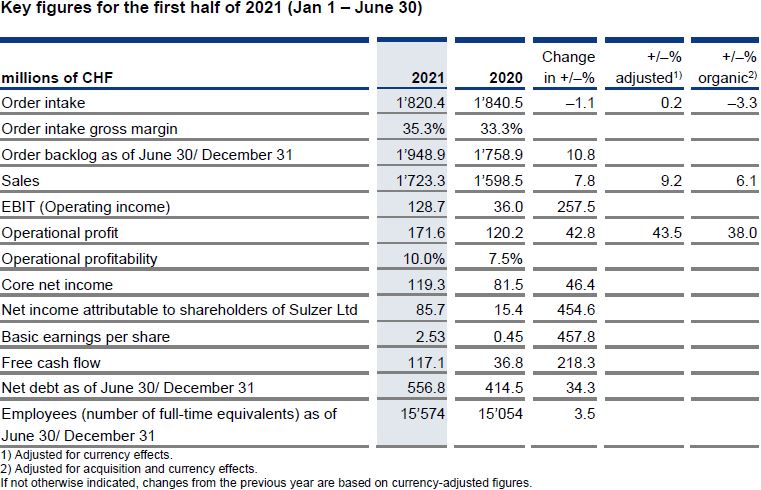

Continuing commercial momentum, positive mix effect

Orders grew again (8% sequentially) in Q2 2021, delivering an H1 order intake of CHF 1’820.4 million, flat (0.2% increase) year-on-year despite a high comparable base in 2020. Acquisitions contributed CHF 67.4 million and currency translation effects had a negative impact of CHF 24.0 million. Order intake gross margin increased to 35.3%, well up from 33.3% in H1 2020 on a better mix.

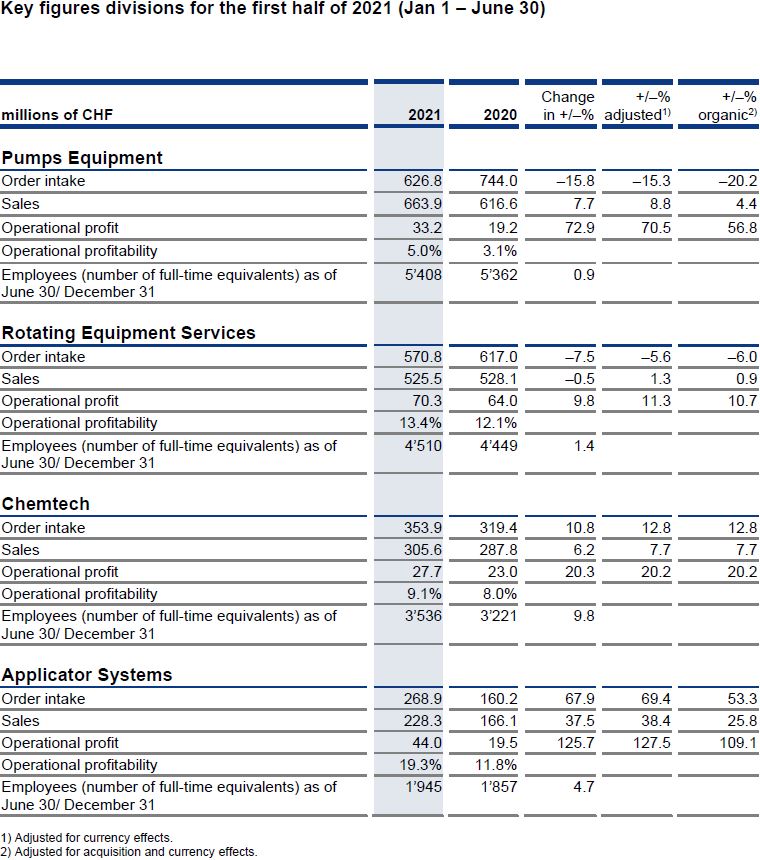

In Pumps Equipment, order growth in Water and Industry only partially offset the programmed drop in Energy, leading to a decrease of 15.3% (-20.2% organically) for the division. Water orders increased by 25.2%, 7.0% of which was organic and CHF 39.4 million from the Nordic Water acquisition. Industry also had a strong H1 2021, with orders up 5.8%. Energy declined by half versus a very strong H1 2020, on a market correction for which we have already adjusted our cost base, and on continued order selectivity to defend the quality of our backlog.

In Q2 2021, Rotating Equipment Services recorded its highest quarterly order intake since Q1 2020, emphasizing the positive sequential momentum in all regions as customers begin to ease site access restrictions. Compared to the record high H1 2020, the division order intake declined 5.6% in H1 2021.

Chemtech’s order intake increased by 12.8% in H1 2021, driven by a strengthening US chemical market and a continuing boom in China. Our Renewables segment also showed solid growth, with H1 orders approaching the level achieved for the full year 2020.

In the Applicator Systems division, orders reached a record level of CHF 268.9 million thanks to strong customer demand coupled with our ability to keep our supply chain up and running. The Haselmeier acquisition contributed CHF 25.5 million. Orders in H1 2021 increased by 69.4% (+53.3% organically) versus H1 2020 and are well above pre-pandemic levels.

We enter the second half of 2021 with a high order backlog of CHF 1’948.9 million (December 31, 2020: CHF 1’758.9 million). Positive currency translation effects totaled CHF 31.1 million.

Sales ramp up in all divisions

Sales increased by 9.2% compared to H1 2020, reaching CHF 1’723.3 million. Organic growth was 6.1% with acquisitions adding CHF 52.1 million, while negative currency translation effects amounted to CHF 22.3 million.

The Pumps Equipment division increased its sales by 8.8% (4.4% organically). Sales in Water increased by 23.7% including the successful Nordic Water acquisition, and 9.3% organically. Sales in Industry increased 12.6%. Overall, Water and Industry more than offset the sales decline in Energy (–4.7%), leading to a positive mix effect. Sales in Rotating Equipment Services were up 1.3% year-on-year, growing in all regions, in part due to the continued easing of customer site restrictions. In Chemtech, sales were up by 7.7% on strong execution in China and a reduced impact from lockdowns compared to last year, particularly for field services. Sales in Applicator Systems rebounded strongly with 38.4% growth in H1 2021 compared to H1 2020. The Haselmeier acquisition contributed CHF 21.3 million. Healthcare now represents 38.5% of Applicator Systems sales.

Operational profitability at 10%, a half-year record

Operational profit amounted to CHF 171.6 million, compared with CHF 120.2 million in the first half of 2020, an increase of 43.5%. The higher gross profit from increased sales and a better mix was further supported by CHF 23 million of savings from implemented resizing measures in the Energy-related businesses and continued spending discipline.

Operational profitability reached a record H1 high of 10.0%, compared with 7.5% in H1 2020.

Return on Sales of 7.5%

One-off expenses in the first half of 2021 amounted to CHF 7.2 million, compared to CHF 52.6 million in H1 2020. The expenses relate to the structural actions to adapt Sulzer’s Energy-related activities, initiated in the first half of 2020. EBIT amounted to CHF 128.7 million, compared with CHF 36.0 million in the first half of 2020. Return on sales (ROS) was 7.5% compared with 2.3% in the same period of 2020.

Record free cash flow generation

Free cash flow amounted to CHF 117.1 million in H1 2021, significantly up compared to the CHF 36.8 million reported in the same period last year, driven by higher net income and improved working capital efficiency.

Proposed spin-off of Applicator Systems

On May 27, Sulzer announced its intention to spin-off its Applicator Systems (APS) division through a 1:1 share split, subject to shareholder approval at the Sulzer EGM to be scheduled for Q3. Upon market introduction, APS will be renamed medmix and Sulzer shareholders will receive one medmix share in addition to each Sulzer share held. medmix’s listing on the Swiss Exchange (SIX) is planned for late Q3 or early Q4 and is expected to be combined with a concurrent share capital increase by medmix in the amount of CHF 200-300 million without subscription rights for existing shareholders, also subject to shareholder approval The spin-off will accelerate the profitable growth of both Sulzer and medmix.

Outlook 2021

The positive trend in order intake continued in Q2, with all divisions again seeing sequential growth. While Q3 is generally seasonally lower, we expect it to show a strong improvement compared to the previous year, driven by continued growth in Applicator Systems and Chemtech, along with a re-acceleration in Rotating Equipment Services and sustained growth in Water and Industry in Pumps Equipment.

We confirm the guidance that was increased on our Capital Markets Day in June. For the full year 2021, we expect orders to increase 4–6%1, sales to be up 8–10%1, and operational profitability between 10.0% and 10.5%.

Without medmix, Sulzer expects 2021 orders to be up 2–3%1 and sales up 6–8%1. Operational profitability is expected to be around 9.0%, above pre-pandemic levels.

1 Adjusted for FX and including acquisitions already closed.

Midyear presentation

Sulzer will hold a conference call on the occasion of the publication of the half year 2021 results today at 11.00 a.m. CEST.

The presentation can be followed by webcast (audio slides) or by dialing-in to the conference call. Please note that the moderator can only take questions from dialed-in participants. Please pre-register for the event to receive dedicated dial-in details to access the call easily and quickly.

The playback of the webcast will be available shortly after the event under the same link.

This document contains forward-looking statements including, but not limited to, projections of financial developments, market activity, future performance of products and solutions or planned transactions containing risks and uncertainties. These forward-looking statements are subject to change based on known or unknown risks and various other factors that could cause actual results, performance or events to differ materially from the statements made herein.

This announcement constitutes neither an offer to sell nor a solicitation to buy securities. This announcement shall also not be considered as an issue prospectus or similar notice in accordance with article 35 et seqq. FinSA and/or article 69 FinSA or as a listing prospectus in accordance with the Listing Rules of SIX Exchange Regulation AG regarding the listing of equity securities on SIX Swiss Exchange Ltd.

Any offer and listing of securities shall be made exclusively by and based on a securities prospectus to be published. Any investment decision regarding publicly offered securities shall only be made based on the securities prospectus. Any offering of securities mentioned herein will not be registered under the United States Securities Act of 1933, as amended (the “Act”), and such securities may not be offered or sold in the United States of America absent registration or an applicable exemption from registration requirements under the Act.

This announcement has been prepared on the basis that any offer of securities in any Member State of the European Economic Area (“EEA”) will be made pursuant to an exemption under Regulation (EU) 2017/1129 (as amended, the “Prospectus Regulation”) from the requirement to publish a prospectus for offers of securities. Accordingly any person making or intending to make any offer in the EEA of the securities which are referred to in this announcement may only do so in circumstances in which no obligation arises for the issuer or any of the initial purchasers of such securities to publish a prospectus pursuant to Article 3 of the Prospectus Regulation or supplement a prospectus pursuant to Article 23 of the Prospectus Regulation, in each case, in relation to such offer.

This announcement and any other documents and/or materials relating hereto is not being made, and such documents and/or materials have not been approved by an authorized person, for the purposes of section 21 of the Financial Services and Markets Act 2000 (the “FSMA”). Accordingly, this announcement is not being made and related documents and/or materials have not been distributed, and must not be passed on, to persons in the United Kingdom (“UK”) other than (i) persons falling within the definition of investment professionals (as defined in Article 19(5) of the Financial Services and Markets Act (Financial Promotion) Order 2005 (as amended, the “Order”), (ii) high net worth entities falling within Articles 49(2)(a) to (d) of the Order, (iii) persons falling within Article 43(2) of the Order, including existing members and creditors of Sulzer, or (iv) persons to whom an invitation or inducement to engage in investment activity (within the meaning of section 21 of the FSMA) may otherwise lawfully be communicated or caused to be communicated (all such persons described in (i) to (iv) above together being referred to as “Relevant Persons”). In the UK, any investment or investment activity to which this announcement or any related documents and/or materials relate is available only to Relevant Persons and will be engaged in only with Relevant Persons. Any person in the UK who is not a Relevant Person should not act or rely on this announcement or any related documents and/or materials or any of its or their contents.

This announcement has been prepared on the basis that any offer of securities in the UK will be made pursuant to an exemption under the Prospectus Regulation as it forms part of domestic law pursuant to the European Union (Withdrawal) Act 2018 (as amended) from the requirement to publish a prospectus for offers of securities. Accordingly any person making or intending to make any offer in the UK of the securities which are referred to in this announcement may only do so in circumstances in which no obligation arises for the issuer or any of the initial purchasers of such securities to publish a prospectus pursuant to Article 3 of the Prospectus Regulation or supplement a prospectus pursuant to Article 23 of the Prospectus Regulation, in each case, in relation to such offer.

Your spokesperson

Media relations

Domenico Truncellito

Group Head of External Communications

Sulzer Management Ltd

8401 Winterthur

Switzerland

Investor relations

Thomas Zickler

Chief Financial Officer

Sulzer Management Ltd

8401 Winterthur

Switzerland