Media release

July 24, 2020Robust performance driven by aftermarket, significant savings on track

Midyear 2020 HIGHLIGHTS

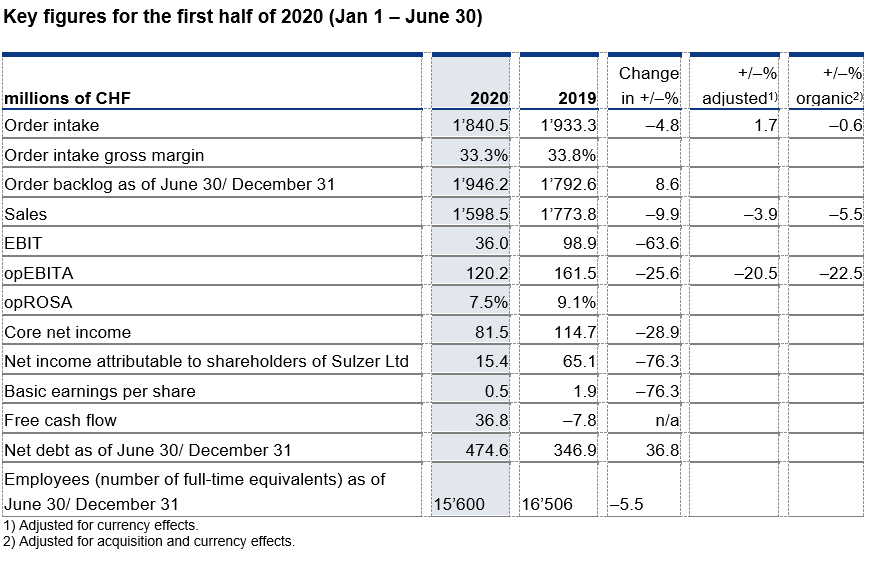

- Orders +1.7% including acquisitions (-0.6% organic)

- Orders in Rotating Equipment Services up 10.2% (6.3% organic)

- Sales -3.9% including acquisitions (-5.5% organic) on lockdowns and supply chain

- Record order backlog of almost CHF 2 billion

- 7.5% operational profitability (opROSA), down 160 bps YoY of which 80% due to Q2 end-market pause in Applicator Systems

- OPEX squeeze progressing with CHF 21m delivered in Q2 2020

- Structural savings of CHF 70m in Energy-related activities initiated, CHF 50m to be delivered in 2021. One-off costs CHF 80m, of which CHF 53m booked in H1

- Rebound under way with operational profitability expected at 8.5-9.0% for financial year 2020, around pre-pandemic levels in 2021

Abbreviations: EBIT: Operating income, opEBITA: Operating income before restructuring, amortization, impairments and non-operational items, opROSA: Return on sales before restructuring, amortization, impairments and non-operational items (opEBITA/sales), FTE: Full-time equivalents

If not otherwise indicated, changes from the previous year are based on currency-adjusted figures.

Solid order momentum in Pumps Equipment and Rotating Equipment Services

Despite the pandemic, Sulzer continued to deliver order growth in the first half of 2020. Order intake totaled CHF 1’840.5 million, an increase of 1.7% compared with the same period last year. Organic order intake remained stable (–0.6%), while acquisitions added CHF 42.3 million. Order intake gross margin declined 50 bps to 33.3% on the mix impact from a lower relative share of orders from Applicator Systems.

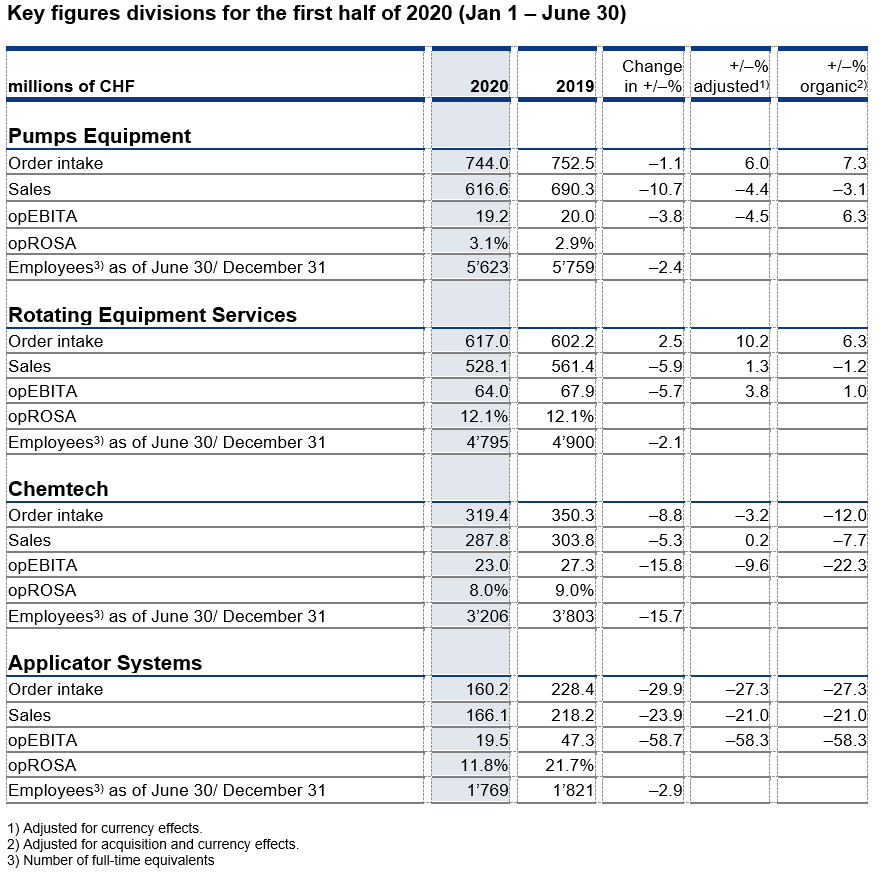

Order intake in Rotating Equipment Services grew by 10.2%, of which 3.9% stemmed from the Alba acquisition. All three service product lines and all three regions performed well despite market disruptions and restricted access to customer sites.

Orders in the Pumps Equipment division were up 6.0%. The Municipal and Wastewater activities showed continued momentum and grew by 2.5% organically. Energy-related orders were boosted by the Middle East, China and Brazil, which more than offset a steep decline in the US. Orders for Industry were down 6.3% on a COVID-19-related softening of market.

Chemtech orders were 3.2% lower than in the first half of 2019, on customer postponements of larger projects and a high basis for comparison in the first half of 2019. The GTC acquisition contributed CHF 20.1 million to orders.

Applicator Systems saw an abrupt drop in order intake of 27.3% as beauty outlets and dental practices were forced to temporarily close around the world.

Currency translation effects had a negative impact on order intake amounting to CHF 125.8 million, due to the strengthening of the Swiss franc against other currencies.

As of June 30, 2020, order backlog increased by CHF 153.6 million to CHF 1’946.2 million from CHF 1’792.6 million on December 31, 2019.

Lockdowns impacting sales

Sales amounted to CHF 1’598.5 million – a decrease of 3.9%. Compared with 2019, acquisitions added CHF 27.1 million, while negative currency translation effects reduced sales by CHF 106.8 million.

Customer confinement measures such as limited site access and temporary closures of factories and front-end outlets impacted sales. Sales in Rotating Equipment Services grew by 1.3%, supported by the Alba acquisition. Pumps Equipment’s sales declined by 4.4%. Higher sales in the Water segment could not offset the decrease in Energy and Industry. In Chemtech, sales remained stable, despite a significant COVID-19 impact including the six-week lockdown of the Indian factory from the end of March until the beginning of May. In Applicator Systems, sales declined by 21.0%, caused by the abrupt closure of retail stores and dental clinics globally.

Operational return on sales of 7.5%

Operational profit (opEBITA) amounted to CHF 120.2 million compared with CHF 161.5 million in the first half of 2019, a decrease of 20.5%. Lower gross margin and under-absorption arising from the sales volume drop, as well as the unfavorable mix effect from lower share of Applicator Systems, were partially offset by cost savings. Operating expenses excluding amortization, impairments, restructuring and other non-operational items decreased by CHF 21.7 million year-on-year. Lower organic Selling and G&A expenses were partially offset by operational expenses of the acquired companies. Operational profitability decreased to 7.5% compared with 9.1% in the first half year of 2019.

Structural actions to adapt to a changing Energy landscape

As announced earlier this year, Sulzer has initiated decisive measures to mitigate the impact of market disruptions on its Energy-related business activities. Structural savings of CHF 70 million will be delivered, of which CHF 50 million in 2021. Associated one-off implementation costs are CHF 80m, of which CHF 53m million were recorded in the first half of the year, comprised of CHF 42.0 million restructuring expenses, CHF 6.4 million non-operational costs and CHF 4.2 million impairments. These mainly relate to the closure or resizing of sites in Europe and the USA, as well as the resizing of supporting resources.

Consequently, EBIT amounted to CHF 36.0 million, down from CHF 98.9 million in the first half of 2019, mostly due to these CHF 53m of one-off implementation costs. Return on sales (ROS) therefore dropped to 2.3% compared with 5.6% in the first half of 2019.

Outlook 2020

The current business environment is characterized by high uncertainty, driven by COVID-19 and its economic fallout. Having initiated ambitious cost measures to mitigate the impacts of the pandemic, and based on our high order backlog, we are optimistic that we will continue to perform well. We expect operational profitability to be at 8.5–9.0% for the full year 2020, and to return to around pre-pandemic levels for the full year 2021.

Abbreviations: opEBITA: Operating income before restructuring, amortization, impairments and non-operational items, opROSA: Return on sales before restructuring, amortization, impairments and non-operational items (opEBITA/sales)

Details on the performance of the divisions can be found in the Midyear Report 2020.

Midyear presentation

Sulzer will hold a conference call on the occasion of the publication of the midyear 2020 results today at 11.00 a.m. CEST.

The presentation can be followed by webcast (audio slides) or by dialing-in to the conference call. To access the webcast or to dial in to the conference call, use the following links and numbers, respectively:

Webcast

- www.sulzer.com/myr20-webcast

The playback of the webcast will be available shortly after the event under the same link.

Dial-in

- Local – London, United Kingdom: +44 (0) 207 107 0613

- Local – New York, United States of America: +1 (1)631 570 5613

- Local – Geneva, Switzerland: +41(0)58 310 5000

- Other international numbers are available here.

Please dial in 5 minutes before the start of the conference call

Key dates in 2020

October 29 - Order intake Q1 – Q3 2020

Your contacts

Media Relations

Domenico Truncellito

Group Head of External Communications

Sulzer Management Ltd

Investor Relations

Thomas Zickler

Chief Financial Officer

Sulzer Management Ltd