Ad hoc announcement pursuant to Art. 53 LR

September 06, 2021Listing of medmix on SIX Swiss Exchange and concurrent capital increase

- Sulzer confirms its intention to list the shares of medmix AG, a leader in high-precision delivery devices in healthcare, industrial and consumer end-markets, on SIX Swiss Exchange. Subject to market conditions, a concurrent CHF 200-300m capital increase is planned to fund growth initiatives

- At the extraordinary shareholders’ meeting of Sulzer Ltd, to be held on September 20, 2021, Sulzer’s board of directors will propose to the shareholders to approve the spin-off of its Applicator Systems business, to be renamed medmix, by way of a symmetrical split

- Existing shareholders will receive one medmix share in addition to each Sulzer share held

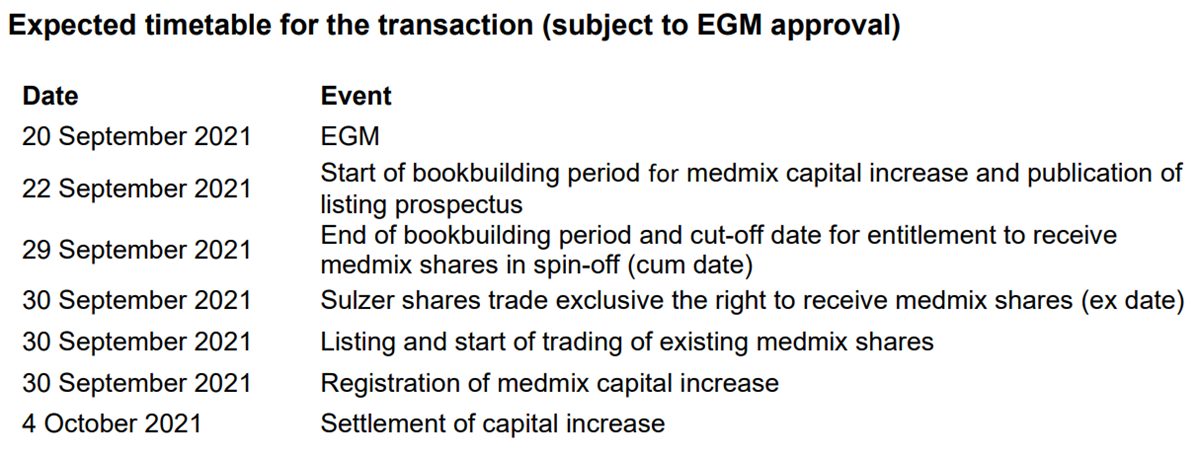

- Trading start of medmix shares resulting from the spin-off from Sulzer Ltd. is expected to take place on September 30, 2021

- medmix designs, develops and produces innovative high-precision delivery devices for the mixing, application and injection of liquids for the healthcare, consumer and industrial end-markets. The Company benefits from its diversified exposure to growing end-markets which are supported by long-term mega trends, such as the growing middle class, population aging and the trend towards increased urbanization, homecare and sustainability

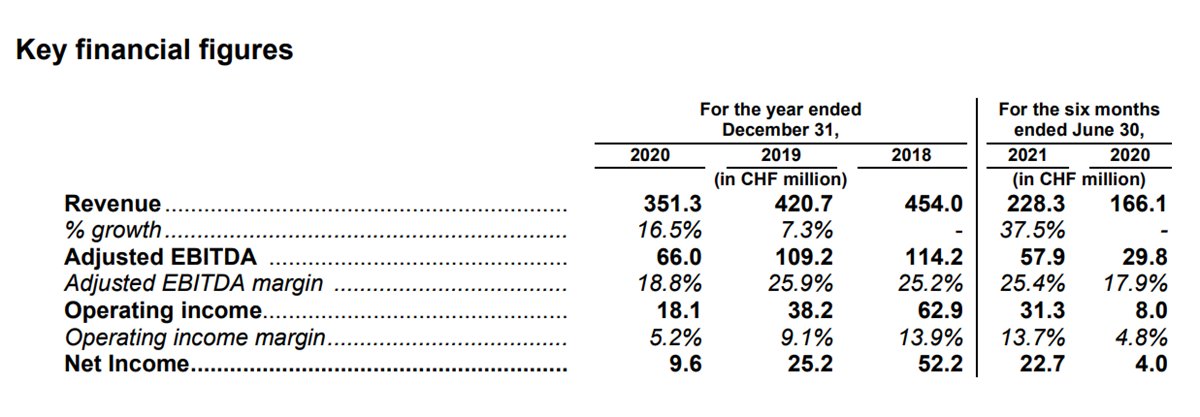

- The Company’s attractive financial profile offers substantial revenue growth and highly resilient margins. In H1 2021, medmix generated revenues of CHF 228.3m with an adjusted EBITDA margin of 25.4%

- Led by CEO Girts Cimermans and CFO Jennifer Dean, medmix is run by a proven leadership team with the required sector expertise to deliver on the strategy to sustainably achieve profitable growth

- Financial outlook: 2021 revenue expected at around CHF 450m, high single digit growth for 2022 and 8% CAGR mid-term targeted. Profitability (adjusted EBITDA margin) in 2021 expected at approximately 25%, estimated above 26% in 2022, mid-term target around 30%

Global market leader in high-precision delivery devices in attractive niche markets in the healthcare, consumer & industrial sectors

medmix offers delivery devices to business-to-business customers operating in attractive market niches with long-term growth prospects due to underlying mega trends. In all of these niches, medmix is among the top five companies (measured in terms of sales). In the Dental market segment, medmix is considered the market leader in two-component mixing systems for prosthetics. In the Drug Delivery segment, medmix is the market leader in the fertility drug pen injectors. In the Industry market segment, it is a market leader for two-component hand-held application systems. In the Beauty market segment, medmix is a market leader in mascara microbrushes. medmix operates 13 production, logistics and distribution sites throughout the world. As of December 31, 2020, the company employed 1,894 full-time-equivalent employees.

Technology leadership backed by a strong intellectual property and innovation

medmix has a strong heritage of setting industry standards through the continuous launch of innovative products. For example, in 1980, it invented dental mixing devices, which were continuously developed until the launch of the market standard S-System in 1997. Since then, new features have been added regularly. In 2021, a new innovation was launched with the T-MixerTM ColibriTM Plus Breakable, a mixing tips and system solution that dispenses and applies multicomponent materials in the dental space. In addition to its complete injector pen portfolio, the Drug Delivery market segment is developing a best-in-class autoinjector. A significant share of its products, particularly in Healthcare, is protected by patents and other registered intellectual property rights. medmix estimates that more than half of its revenue is based on products protected by approximately 900 active patents. In the last three financial years, 5-6% of annual revenue was dedicated to research and development on average.

Attractive financial profile with a track record of sustained profitability

medmix has an attractive financial profile with a track record of high adjusted EBITDA margins. With a gross profit margin in excess of 60% in the financial years 2018, 2019 and 2020, the Healthcare business area is considered a strategic priority and is targeted to generate more than 50% of the company’s revenue in the medium term, while the Consumer & Industrial business area is also expected to accelerate its growth. In H1 2021, medmix generated revenues of CHF 228.3m with an adjusted EBITDA margin of 25.4%.

Financial outlook

For the current financial year, revenue of approximately CHF 450m is expected, driven by a revenue recovery across all segments to pre-COVID-19 pandemic levels, the full integration of Haselmeier and the completion of the transformation of the Beauty market segment. For the year ending December 31, 2022, medmix aims to achieve high single-digit revenue growth based on its strong product pipeline and positive customer sentiment across all segments. In the mid-term, medmix targets revenue growth at a CAGR of 8% by leveraging its leading technologies and applications, particularly in the Healthcare business area. Profitability (adjusted EBITDA margin) in 2021 is expected at about 25% and a return to pre-pandemic levels of above 26% in 2022. medmix expects to continue the positive development by growing faster than its end markets and increase revenue mix towards healthcare, to reach its mid-term adjusted EBITDA margin target of around 30%.

Outline of the proposed listing and capital increase

The spin-off of medmix will be executed in the form of a symmetrical demerger according to art. 29 para b) and art. 31 para 2a) of the Swiss Merger Act, with existing shareholders receiving one medmix share in addition to each Sulzer share held, subject to shareholder approval at the Extraordinary General Meeting of Sulzer Ltd on September 20, 2021 (the “EGM”). It is currently anticipated that the medmix shares resulting from the spin-off will be traded on SIX Swiss Exchange as of September 30, 2021.

Concurrently with the spin-off, medmix plans, subject to market conditions, to raise CHF 200- 300m of capital in an offering of shares to be newly issued from the Company’s authorized capital (excluding subscription rights of existing shareholders). The planned capital increase is intended to fund growth initiatives, increase trading liquidity and provide new healthcare-focused investors with an opportunity to invest in medmix at the time of listing. Current reference shareholder Tiwel Holding will not participate in the planned capital increase, which would increase the free float of medmix.

Credit Suisse and UBS are acting as exclusive financial advisors to Sulzer in the context of the proposed spin-off.

This document contains forward-looking statements including, but not limited to, projections of financial developments, market activity, future performance of products and solutions or planned transactions containing risks and uncertainties. These forward-looking statements are subject to change based on known or unknown risks and various other factors that could cause actual results, performance or events to differ materially from the statements made herein.

This announcement constitutes neither an offer to sell nor a solicitation to buy securities. This announcement shall also not be considered a prospectus or similar notice in accordance with article 35 et seqq. Financial Service Act (“FinSA”) and/or article 69 FinSA . Any offer and listing of securities shall be made exclusively by and based on a securities prospectus to be published. Any investment decision regarding publicly offered securities shall only be made based on the securities prospectus. Copies of the securities prospectus and any supplements to the offering prospectus are/will be available free of charge in Switzerland for 12 months following the first day of trading on SIX Swiss Exchange at Credit Suisse AG, Zurich, Switzerland (email: equity.prospectus@credit-suisse.com), and UBS AG, Prospectus Library, P.O. Box, CH-8098 Zurich (email: swiss-prospectus@ubs.com), and at the offices of the Company, Dammstrasse 19, 6300 Zug (email: investorrelations@medmix.com). This document constitutes advertising in accordance with article 68 FinSA. Such advertisements are communications to investors aiming to draw their attention to financial instruments. Any investment decisions with respect to any securities should not be made based on this advertisement.

Copies of this document may not be sent to jurisdictions, or distributed in or sent from jurisdictions, in which this is barred or prohibited by law. The information contained herein shall not constitute an offer to sell or the solicitation of an offer to buy, in any jurisdiction in which such offer or solicitation would be unlawful prior to registration, exemption from registration or qualification under the securities laws of any jurisdiction.

Any offering of securities mentioned herein will not be registered under the United States Securities Act of 1933, as amended (the “Act”), and such securities may not be offered or sold in the United States of America absent registration or an applicable exemption from registration requirements under the Act. There will be no public offering of the securities mentioned herein in the United States of America.

This announcement has been prepared on the basis that any offer of securities in any Member State of the European Economic Area (“EEA”) will be made pursuant to an exemption under Regulation (EU) 2017/1129 (as amended, the “Prospectus Regulation”) from the requirement to publish a prospectus for offers of securities. Accordingly any person making or intending to make any offer in the EEA of the securities which are referred to in this announcement may only do so in circumstances in which no obligation arises for the issuer or any of the initial purchasers of such securities to publish a prospectus pursuant to Article 3 of the Prospectus Regulation or supplement a prospectus pursuant to Article 23 of the Prospectus Regulation, in each case, in relation to such offer.

This announcement and any other documents and/or materials relating hereto is not being made, and such documents and/or materials have not been approved by an authorized person, for the purposes of section 21 of the Financial Services and Markets Act 2000 (the “FSMA”).

Accordingly, this announcement is not being made and related documents and/or materials have not been distributed, and must not be passed on, to other than persons who (i) are outside the UK; (ii) have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act (Financial Promotion) Order 2005 (as amended, the “Order”), or (iii) are high net worth entities falling within Articles 49(2)(a) to (d) of the Order (high net worth companies, unincorporated associations, etc.) (all such persons described in (i) to (iii) above together being referred to as “Relevant Persons”). In the UK, any investment or investment activity to which this announcement or any related documents and/or materials relate is available only to Relevant Persons and will be engaged in only with Relevant Persons. Any person in the UK who is not a Relevant Person should not act or rely on this announcement or any related documents and/or materials or any of its or their contents.

This announcement has been prepared on the basis that any offer of securities in the UK will be made pursuant to an exemption under the Prospectus Regulation as it forms part of domestic law pursuant to the European Union (Withdrawal) Act 2018 (as amended) (the “UK Prospectus Regulation”) from the requirement to publish a prospectus for offers of securities. Accordingly any person making or intending to make any offer in the UK of the securities which are referred to in this announcement may only do so in circumstances in which no obligation arises for the issuer or any of the initial purchasers of such securities to publish a prospectus pursuant to section 85 of the FSMA or supplement a prospectus pursuant to Article 23 of the UK Prospectus Regulation, in each case, in relation to such offer.

Credit Suisse and UBS are acting on behalf of Sulzer Ltd and no one else in connection with the proposed spin-off and will not be responsible to any other person for providing the protections afforded to their clients or for providing advice in relation to the proposed spin-off.

Your spokesperson

Media relations

Domenico Truncellito

Group Head of External Communications

Sulzer Management Ltd

8401 Winterthur

Switzerland

Investor relations

Thomas Zickler

Chief Financial Officer

Sulzer Management Ltd

8401 Winterthur

Switzerland